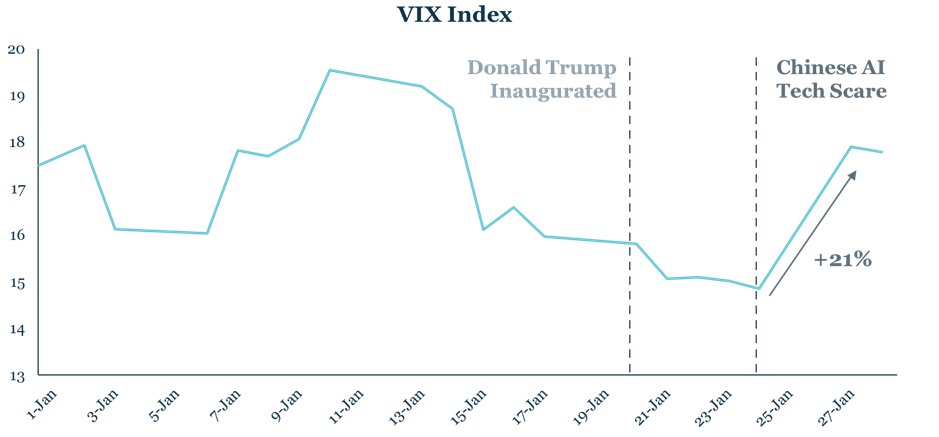

Uncertainty and shock over the reciprocal tariffs announced on ‘Liberation Day’ by the new US administration has, to put it bluntly, created market chaos. The sharp global sell-offs are reminiscent of the turmoil experienced during the Covid-19 pandemic. As was the case then, few have been spared. Trump’s recent decision to delay reciprocal tariffs for 90 days applicable to any country that has not retaliated, has provided markets with what appears to be a temporary lifeline.

However, we do not interpret this as a signal that markets have bottomed, nor do we assume this policy will necessarily hold given Trump’s unpredictability. Rather, this move appears to reflect a form of targeted pressure—some might say economic bullying—directed against China, particularly given that it remains the only country to have retaliated thus far. As a result, market confidence has been deeply shaken and we can expect elevated volatility and uncertainty to persist in the coming months.

Like many, we had anticipated the possibility of rising protectionism under a second Trump administration, though not to the extent we seem to be witnessing now. In recent months, we have proactively assessed the potential impact of higher tariffs on our portfolio. Each individual position has been carefully reviewed under this assumption, and we continue to re-evaluate our holdings in light of the evolving situation.

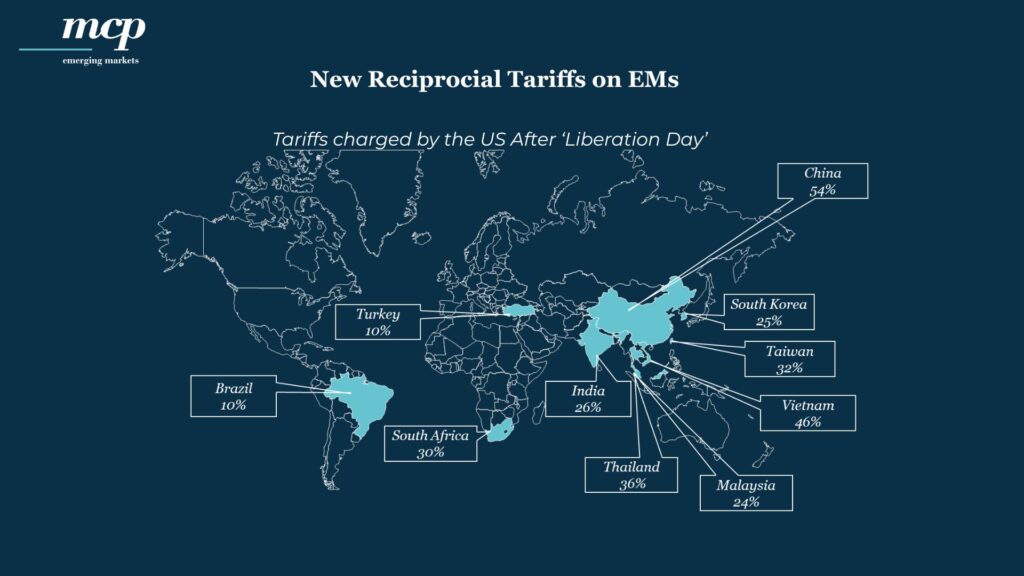

As far as the direct impact of Trump’s reciprocal tariffs is concerned, we believe companies exporting physical goods to the U.S. from countries facing the steepest approved tariff increases are likely to be most affected. Fortunately, although our portfolio includes companies based in several of these countries—which could be hit hard if the announced ‘Liberation Day’ tariffs are fully implemented—our current assessment suggests the immediate impact on our holdings may be limited. Many of our portfolio companies have minimal direct export exposure to the affected sectors, providing a degree of insulation from near-term disruption.

Take Classys, a Korean medical device manufacturer facing a potential 32% tariff on its U.S. imports. The company derives less than 5% of its revenue from sales to the U.S., significantly reducing the potential impact on overall earnings. The bulk of its revenue, approximately 35%, comes from the domestic Korean market, while Europe and Southeast Asia each contribute around 20%. Japan and Brazil account for roughly 10% each, providing further geographic diversification.

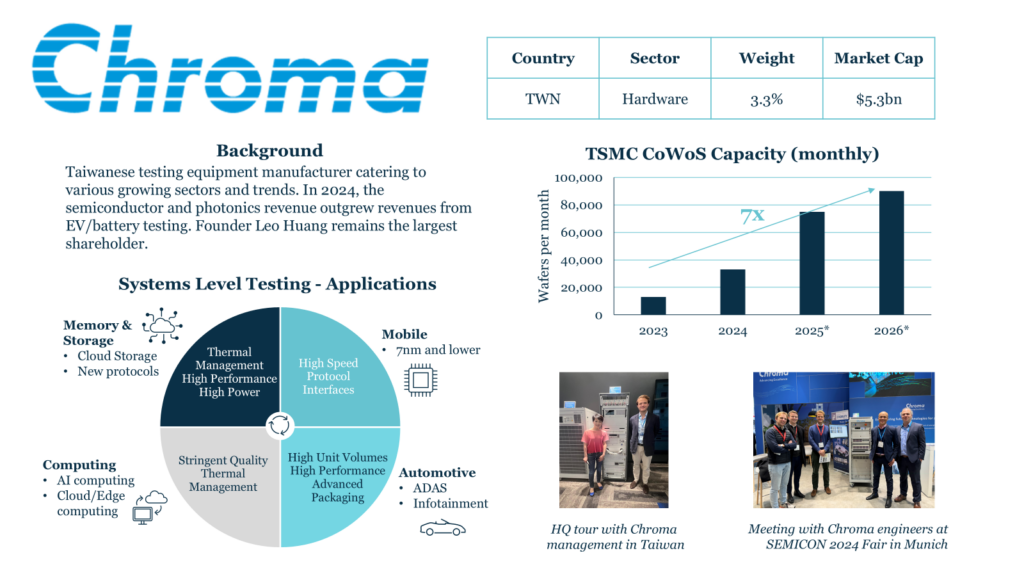

Additionally, the top three US-revenue exposed companies in our portfolio are asset-light, IP-based software companies. As a services industry, they are not directly targeted by the new tariffs. Furthermore, semiconductors are currently excluded from the newly announced tariffs. But the situation remains highly fluid. While chips themselves are not directly taxed, components that contain them, such as laptops and smartphones, had been at risk of future levies. However, over the weekend, the White House appeared to grant temporary exemptions for certain electronics, including smartphones, laptops, hard drives and flat-panel monitors. At the same time, a Section 232 investigation into semiconductor imports has been launched, raising the prospect of targeted tariffs based on national security grounds. We are closely monitoring developments in this sector, as it remains a potential flashpoint in the broader trade narrative.

Finally, we also prioritise business models oriented towards domestic consumption in select markets. As a result, our consumer holdings have minimal direct exposure to U.S. demand, with the exception being a Turkish apparel retailer, which derives less than 5% of its revenue from the U.S.

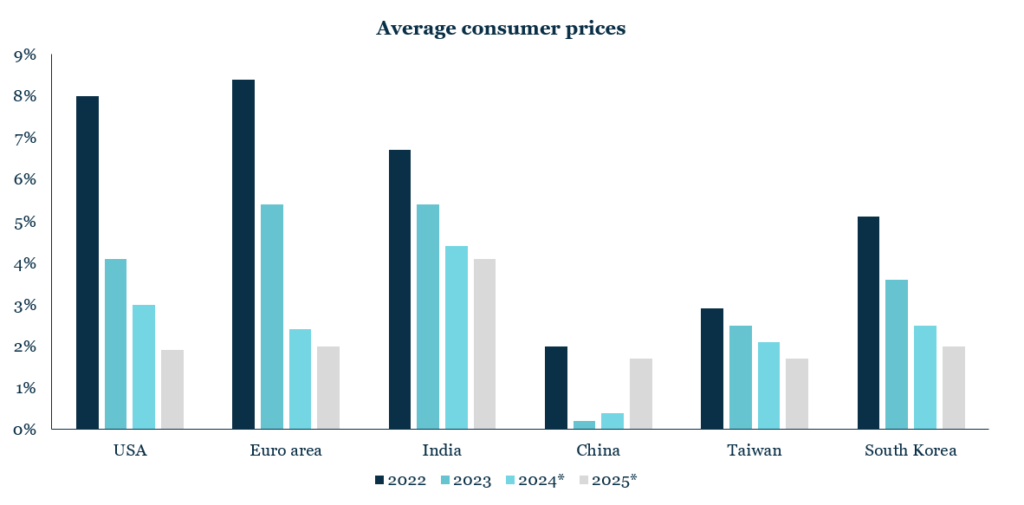

Beyond the direct taxation of goods, few businesses are likely to escape the broader, more insidious effects of escalating tariffs. Even in cases where companies are not directly targeted, tariff-induced slowdowns in demand and profitability can ripple through global supply chains, dampening investment sentiment and tightening margins. These second-order effects pose significant risks—not just to individual companies, but to entire economies. From shifts in consumer spending patterns to declining trade volumes and tightening financial conditions, the cumulative pressure could contribute to a broader global economic slowdown. We are actively assessing these cross-currents as we evaluate portfolio exposure and position for resilience.

In the meantime, the trade war between the US and China has exploded into full force. At the time of writing, the US has imposed tariffs of 145% on Chinese imports, while China has responded with tariffs of 125% on US goods. Who knows how much higher these could go. This extreme tariff war between the US and China alone will have serious repercussions across the global economy.

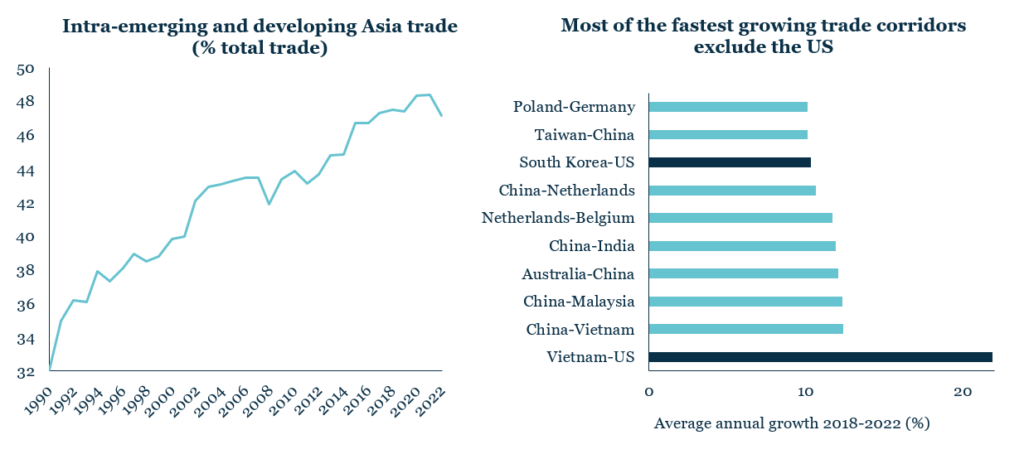

Amidst the chaos here are some glimmers of light on the tariff horizon. It’s worth remembering that we’ve been through a Trump-led trade war before, and global trade patterns had already begun to shift well before the current escalation. One of the most important structural changes over the past few decades has been the rise of South-South trade, particularly across Asia. Between 2007 and 2023, trade among developing countries more than doubled, from $2.3 trillion to $5.6 trillion, largely driven by Asia1. Intra-Asia trade alone is projected to grow from $4.3 trillion in 2023 to $7.1 trillion by 20302.

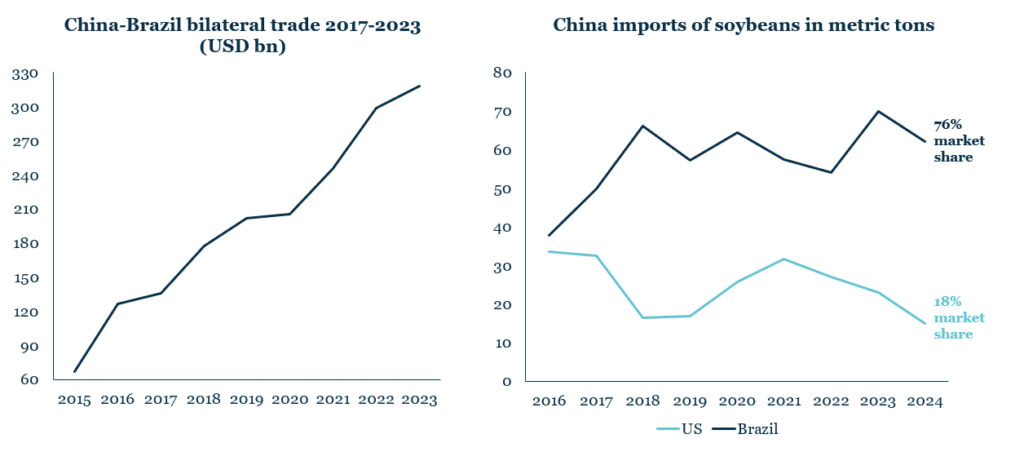

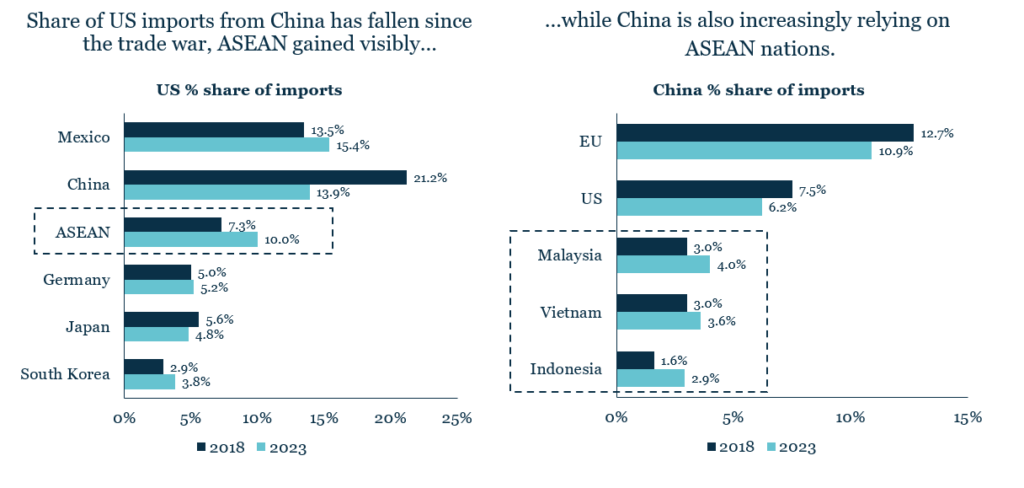

This diversification accelerated following the 2018 U.S.-China trade war, prompting countries to reduce reliance on U.S. imports. For example, China’s share of exports to the U.S. declined from 19% in 2017 to 14.7% in 20243. At the same time, many countries have been pursuing bilateral and regional trade deals that exclude the U.S. Notably, the Regional Comprehensive Economic Partnership (RCEP), signed in 2020, includes 15 Asia-Pacific nations and covers around 28% of global trade.

Although the U.S. will remain a dominant global importer, the accelerating pivot away from dependence on its market places many economies in a stronger position to withstand rising U.S. tariffs. We expect this trend to continue gaining momentum in light of recent developments, as countries intensify efforts to expand trade partnerships beyond the U.S.

In this uncertain environment, our top priority is to stay close to our portfolio companies and continuously reassess our investment theses in light of new insights and ongoing dialogue with stakeholders. To that end, we have scheduled additional research travel to remain close to developments on the ground and ensure we are ready to adapt swiftly as conditions evolve—especially given the many unknowns that remain, including the durability of the 90-day pause and the potential for new trade deals.

We believe experience and steadiness are vital during periods of heightened volatility. The MCP team has been through many market cycles, including the Asian financial crisis, the global financial crisis, and—during MCP’s own tenure—the Covid-19 pandemic. Since our launch in 2018, amid the first U.S.-China trade war, we believe we have guided the fund through an extraordinary period marked by global disruption, rising geopolitical tensions, inflationary shocks, tech sector uncertainty, and the renewed political ascent of Donald Trump.

Today’s surge in market volatility bears strong resemblance, in our view, to the dislocation seen in early 2020, when fear overtook fundamentals. At that time, we believe the team responded swiftly and strategically repositioning the portfolio to take advantage of market dislocations and initiating positions in high-quality companies from our watch list. These were businesses with sound fundamentals and durable models, which we believed were being unduly punished by market sentiment.

We believe this timely and deliberate response, combined with the quality of our portfolio holdings—characterised by competitive strength, solid balance sheets, robust corporate governance, and leadership in innovation—was a key contributor to the fund’s strong outperformance. By 8 October 2020, just 261 days after the Covid-related market peak, MMIT had recovered its losses. From the trough to the subsequent peak on 11 November 2021, the fund delivered a return of 168.7% over a 660-day period, before concerns around global rate hikes began to weigh on broader markets.

As long-term investors, we view the current environment through a similar lens. We do not believe this is a time to retreat, but rather an opportunity to build positions in resilient companies with strong fundamentals—businesses we believe are well-positioned to benefit from a long-term recovery particularly as history shows that the subsequent bull market tends to outperform its preceding bear market.

1 UNCTAD

2 HSBC Forecast

3 FT Analysis