View Article in This is Money

Blog

-

Meet the manager: Carlos von Hardenberg

We’re excited to share the AIC’s Meet the Manager feature with Carlos von Hardenberg, Lead Manager of Mobius Investment Trust and the Mobius Emerging Markets Fund.

If you weren’t a fund manager, what job would you do?

I would have loved to be an entrepreneur, as I’ve always admired their vision, courage, and resilience in turning ideas into lasting businesses. Although I guess that mirrors what we do as investors – seeking out listed companies often still led or owned by founding families, backing those with genuine entrepreneurial spirit and a long-term horizon, and helping them grow further through our active engagement.

What was the proudest moment of your career?

For me, pride comes less from one single moment and more from a 25-year journey in investing, constantly learning, finding new opportunities, and growing along the way. None of this would have been possible without the unwavering support of my wife, who not only encouraged me but also moved with me across countries and continents. That partnership has been the foundation for everything I’ve been able to achieve professionally.

What was the most difficult moment of your career and why?

In hindsight, leaving Franklin Templeton was a big step and did not come easy, as I had great respect and appreciation for my colleagues there. That said, setting up a new fund in this industry, especially doing so only a year and a half before the Covid-19 pandemic broke out, was the greatest challenge of my career.

What advice would you give to your 20-year-old self?

Be curious, open-minded and travel as much as possible. In terms of investing, focus on Asia as this is where a lot of the greatest innovation lies.

Away from the workplace, how do you spend your time?

I enjoy spending time with my family and being outdoors, whether that’s hiking in the mountains, cycling or simply exploring nature together.

Tell us about the last book you read.

The last book I read was Chip War. It offers a fascinating account of the semiconductor industry, weaving together historical context, geopolitical dynamics, and the stories of the individuals who shaped it. I found the discussion of Russia’s role particularly insightful, as well as the vivid characterisations of the pioneers behind the industry. Alongside the biography of Morris Chang, it’s a must-read.

What’s the last concert you went to?

The Weeknd, amazing! And Ann-Sophie Mutter in New York, mind-blowing!

What is your favourite film of all time and why?

The Usual Suspects and The Godfather. Amazing acting, great music and unparalleled tension.

In your personal life, what would you like to achieve in the next 12 months?

Quality time with friends and family, as well as good leadership to support my colleagues.

🔗 https://www.theaic.co.uk/aic/news/commentary/meet-the-manager-carlos-von-hardenberg [theaic.co.uk]

-

MEMF Q3 2025 Manager Commentary

”It’s not what happens to you, but how you react that matters.”

Epictetus

Dear Fellow MEMF Shareholder,

This year reminded us what active investing truly means — to act when necessary, to be patient when appropriate, and to hold conviction when it stands tested, revisited, and reaffirmed under new circumstances.

Active investing can also mean diverging from the market — sometimes sharply. That divergence can be uncomfortable in the short term, as it has been this year, but it is also what drives long-term results. By definition, active investing means being different from the benchmark, taking positions built on conviction, not composition, and aiming to deliver differentiated and sustainable returns. In previous years, the same approach led to significant outperformance, and we believe it has once again left the portfolio better positioned for what lies ahead. Our focus remains unchanged: we aim to invest in high-quality, well managed companies that compound value over time and align with our strategy and responsible investment principles.

Portfolio companies have shown the same proactive spirit. CarTrade for example, expanded through the OLX integration and doubled its user reach; E Ink committed to new capacity for next-generation displays; TOTVS continued to build on its strategic acquisition of StoneCo’s Linx unit to strengthen its leadership in enterprise retail software; and Park Systems continued to broaden its nanotechnology tools across industries, just to name a few.

This spirit and innovation is clearly paying off as companies across the portfolio have delivered strong Q2 reports with many beating expectation and upgrading their outlooks for the coming years. CarTrade’s revenue increased by 22% YoY and Profit After Tax increased 106% YoY; E Ink’s revenue increased by 35% YoY and gross margin increased by 60% (+15pp); TOTVS’ earnings beat their EPS estimate by +1.6%; and Park Systems’ revenue increased by 17% YoY, 5% ahead of Bloomberg consensus.

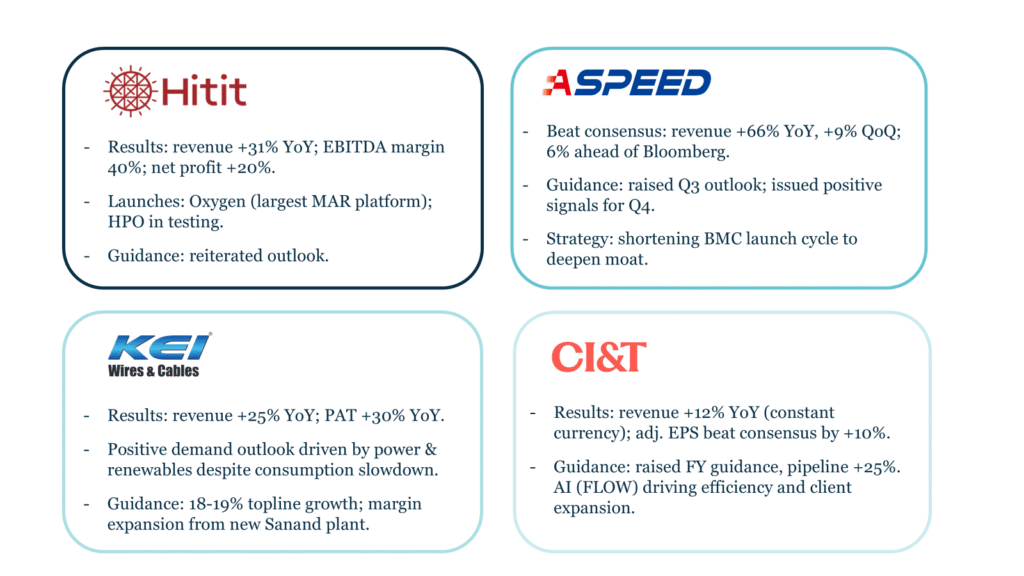

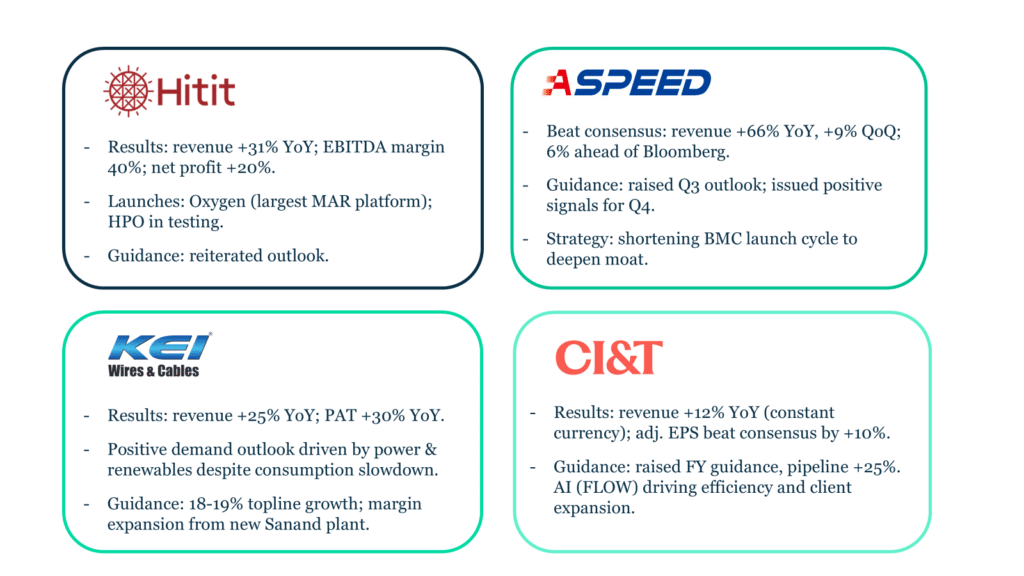

Fundamentals Should Drive Recovery: Q2 2025 Reports

Source: MCP, Bloomberg, company source. Figures refer to past performance. Past performance is not a guide to future performance. Despite these strong company-level results, this year has been challenging, with gains concentrated in benchmark-heavy countries and sectors. Tariff-related uncertainty in the first half of the year pushed investors toward “safe havens,” while in emerging markets, value outperformed quality as capital rotated into lower-valuation, more defensive sectors like financials amid EM rate cuts. A defence-led rally boosted industrials, and China’s stimulus- and liquidity-driven rebound lifted the benchmark.

Meanwhile, our overweight in software weighed on performance as companies delayed IT projects in a volatile environment. In general, much of the rally in emerging markets this year has been driven by a handful of mega-cap stocks, while less-known companies have attracted less investor attention. The MSCI Emerging Markets Index is up approximately 28% year-to-date, with internal analysis suggesting that the top ten Asian technology names account for almost half of these gains1.

In Q2, we began to see early signs of a potential reversal, indicating that recent portfolio headwinds may have been cyclical. This view is cautiously supported by improving macro conditions — including easing tariff volatility, momentum in AI and technology, further interest rate cuts, and a declining USD — as well as country-specific catalysts in India, Taiwan, Korea, and Brazil. While these factors could provide a more supportive backdrop, we expect any recovery to become clearer over the course of next year as these trends gradually come into play.

The quarter began with renewed tariff uncertainty as President Trump again delayed the implementation of reciprocal tariffs, allowing time for several major trade deals to be struck with the EU, Korea, and Japan. Finally, tariffs took effect on 1 August across more than 90 countries, hitting India and Brazil hardest at 50%. Since then, trade-related volatility has eased, and markets have reacted less sharply to new tariff announcements than earlier in the year, when smaller emerging-market stocks were disproportionately affected as investors rotated into larger, lower-valued names and other perceived safe-haven assets amid heightened uncertainty.

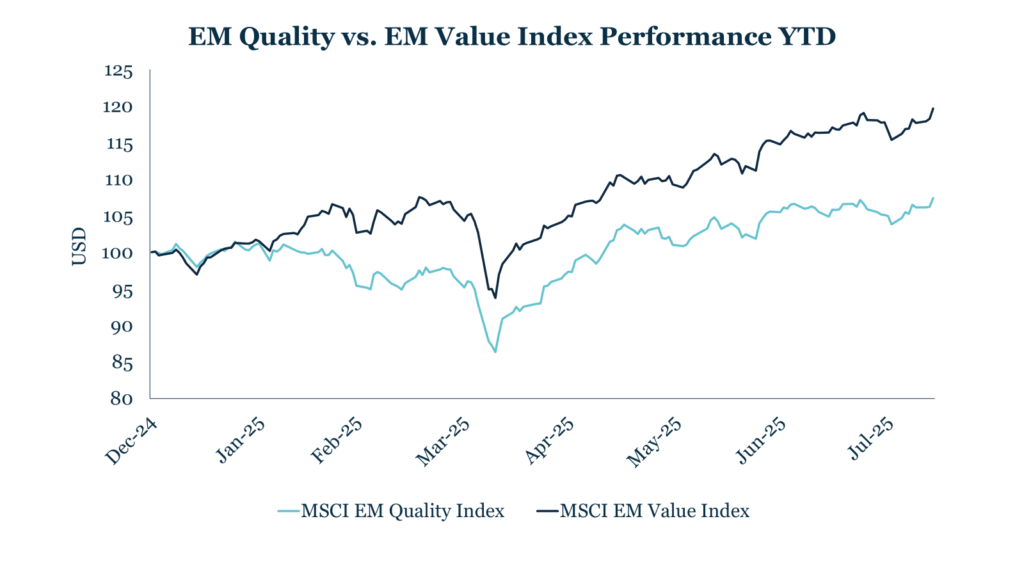

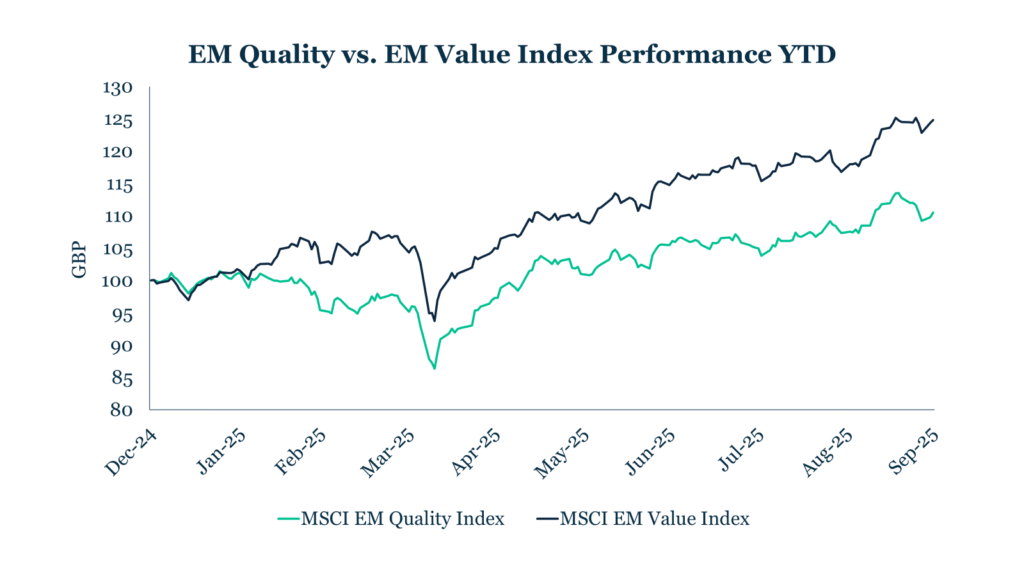

EM Quality has Fallen Behind EM Value YTD

Source: Bloomberg. As of 30 September 2025. During the early-year volatility, we increased our exposure to existing high-conviction names and selectively added new names from our watchlist by taking advantage of attractive valuations and temporary dislocations from companies that we believe were unfairly impacted by broader market sentiment. With tariff related volatility likely subsiding, quality names, should now be better placed for a recovery.

The technology sector once again outperformed most other sectors globally, driving gains in both the US and China. Strong Q2 results from US hyperscalers and confirmation of continued large-scale AI capital expenditure reignited confidence in AI-led growth. To put this into perspective, the Guardian reported that Big Tech has invested more than $155 billion in AI this year2 — roughly equivalent to the cost of building the International Space Station. Meanwhile, policy support for domestic chipmakers and new AI product launches from China’s leading technology firms have fuelled a rally in Chinese and Hong Kong tech stocks.

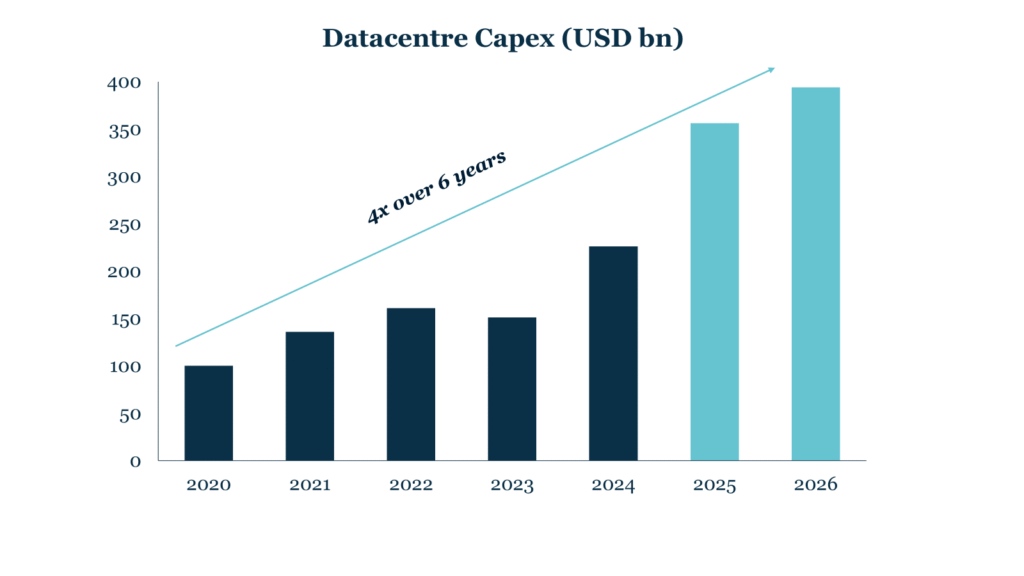

Hyperscaler Capex Driving AI Momentum

Source: CL Taiwan, Daiwa. This strength in US and Chinese technology has also supported companies, including many in our portfolio, in emerging markets like Taiwan and South Korea which play vital roles in AI supply chains. For example, NVIDIA’s Rubin GPU rollout and rising ASIC volumes are boosting demand across the semiconductor supply chain, benefitting companies such as Elite Material, a global leader in high-performance copper clad laminates used in printed circuit boards. In its Q2 report, Elite announced an additional round of capacity expansion in 2026 due to strong demand, with revenue up 40% YoY. Other examples include Chroma raising its guidance for system-level testing revenue in light of rising demand from leading ASIC and GPU projects.

Other positive macro news for emerging markets comes in the form of the Federal Reserve’s first interest rate cut of the year this September, with rates now targeted at 4-4.25%. Fed officials also hinted that further rate cuts would follow in the remainder of the year. Lower US interest rates tend to benefit emerging markets by making lower yielding developed market assets less attractive, potentially prompting investors to seek higher returns in EMs some of which are also experiencing moderating local inflation, lower public debts and higher real rates. This can boost foreign direct investment and support EM asset prices. However, the impact is uneven, as greater risk appetite and lower US yields cannot fully offset weak macroeconomic conditions or poor corporate fundamentals in certain markets. Nevertheless, the continuation of the downward trajectory of global rate cuts should be positive for emerging markets overall.

Within our key markets, local factors are at play indicating the potential for country-level recoveries. Taiwan should benefit from the global AI momentum mentioned above with its global leadership in advanced semiconductors underpinning both industry demand and geopolitical importance. Korea should profit from a semiconductor recovery, as well as governance reforms and its Value Up initiative which is creating potential to unlock shareholder value by improving governance and capital allocation.

Meanwhile, India’s combination of fiscal prudence, resilient domestic consumption grounded in a young population, moderating inflation, and pro-growth policy support creates a constructive macro backdrop underpinning the country’s long term, high growth trajectory. In Brazil, while we expect volatility ahead of the 2026 elections, there is a clear path towards SELIC rate cuts and normalisation of real interest rates which would provide a catalyst for the Brazilian equities market.

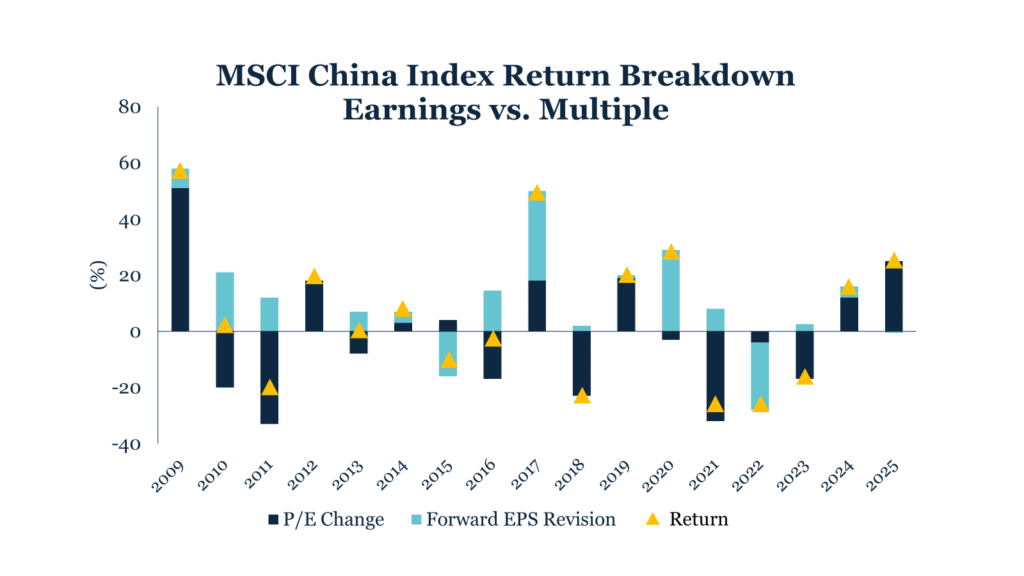

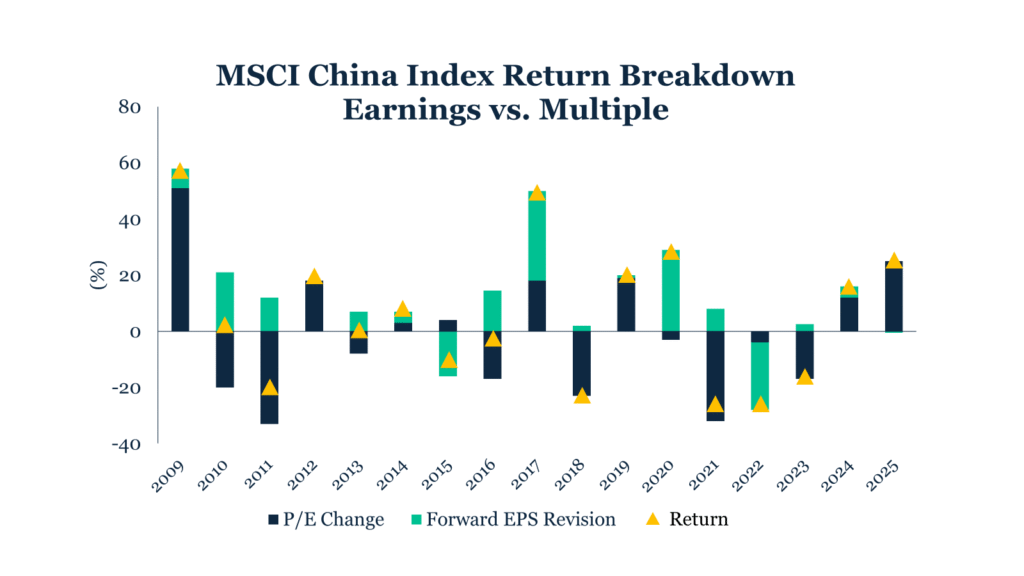

China Rally Driven by Multiple Expansion, Not EPS Growth

Source: Macquarie. While China has dominated headlines this year with a strong market rebound placing it among the top-performing countries, we believe the rally has been driven primarily by sentiment and policy stimulus, rather than underlying fundamentals, as reflected in persistently weak economic data this quarter. The lack of a clear recovery in the real economy raises questions about the rally’s sustainability. Additionally, the rally has been largely concentrated in the tech sector which is now trading at less attractive valuations. For these reasons, we continue to exercise caution. We have been carefully screening the Chinese market across select sectors to identify companies that meet our stringent quality and governance standards. While only a few appear potentially aligned with these criteria, we remain disciplined and will continue our search without compromising on quality.

Overall, as we reflect on the year, we are reminded of Epictetus’ words: “It’s not what happens to you, but how you react to it that matters.” While this year has presented significant challenges, it has only strengthened our conviction in both our strategy and our portfolio companies. Rather than being discouraged by volatility, we used it as an opportunity to deepen our positions in high-quality, well-managed businesses.

By staying disciplined and true to our active, conviction-driven approach, we believe we are now well positioned to benefit from key macro, country and sector specific tailwinds over the coming years. Reflecting this confidence, the team has increased its investment in the strategy — a clear signal of our optimism about the future of our portfolio companies and the opportunities ahead in emerging markets which we intend to capitalise on.

-

MMIT Q3 2025 Manager Commentary

”It’s not what happens to you, but how you react that matters.”

Epictetus

Dear Fellow MMIT Shareholder,

This year reminded us what active investing truly means — to act when necessary, to be patient when appropriate, and to hold conviction when it stands tested, revisited, and reaffirmed under new circumstances.

Active investing can also mean diverging from the market — sometimes sharply. That divergence can be uncomfortable in the short term, as it has been this year, but it is also what drives long-term results. By definition, active investing means being different from the benchmark, taking positions built on conviction, not composition, and aiming to deliver differentiated and sustainable returns. In previous years, the same approach led to significant outperformance, and we believe it has once again left the portfolio better positioned for what lies ahead. Our focus remains unchanged: we aim to invest in high-quality, well managed companies that compound value over time and align with our strategy and responsible investment principles.

Portfolio companies have shown the same proactive spirit. CarTrade for example, expanded through the OLX integration and doubled its user reach; E Ink committed to new capacity for next-generation displays; TOTVS continued to build on its strategic acquisition of StoneCo’s Linx unit to strengthen its leadership in enterprise retail software; and Park Systems continued to broaden its nanotechnology tools across industries, just to name a few.

This spirit and innovation is clearly paying off as companies across the portfolio have delivered strong Q2 reports with many beating expectation and upgrading their outlooks for the coming years. CarTrade’s revenue increased by 22% YoY and Profit After Tax increased 106% YoY; E Ink’s revenue increased by 35% YoY and gross margin increased by 60% (+15pp); TOTVS’ earnings beat their EPS estimate by +1.6%; and Park Systems’ revenue increased by 17% YoY, 5% ahead of Bloomberg consensus.

Fundamentals Should Drive Recovery: Q2 2025 Reports

Source: MCP, Bloomberg, company source. Figures refer to past performance. Past performance is not a guide to future performance. Despite these strong company-level results, this year has been challenging, with gains concentrated in benchmark-heavy countries and sectors. Tariff-related uncertainty in the first half of the year pushed investors toward “safe havens,” while in emerging markets, value outperformed quality as capital rotated into lower-valuation, more defensive sectors like financials amid EM rate cuts. A defence-led rally boosted industrials, and China’s stimulus- and liquidity-driven rebound lifted the benchmark.

Meanwhile, our overweight in software weighed on performance as companies delayed IT projects in a volatile environment. In general, much of the rally in emerging markets this year has been driven by a handful of mega-cap stocks, while less-known companies have attracted less investor attention. The MSCI Emerging Markets Index is up approximately 28% year-to-date, with internal analysis suggesting that the top ten Asian technology names account for almost half of these gains1.

In Q2, we began to see early signs of a potential reversal, indicating that recent portfolio headwinds may have been cyclical. This view is cautiously supported by improving macro conditions — including easing tariff volatility, momentum in AI and technology, further interest rate cuts, and a declining USD — as well as country-specific catalysts in India, Taiwan, Korea, and Brazil. While these factors could provide a more supportive backdrop, we expect any recovery to become clearer over the course of next year as these trends gradually come into play.

The quarter began with renewed tariff uncertainty as President Trump again delayed the implementation of reciprocal tariffs, allowing time for several major trade deals to be struck with the EU, Korea, and Japan. Finally, tariffs took effect on 1 August across more than 90 countries, hitting India and Brazil hardest at 50%. Since then, trade-related volatility has eased, and markets have reacted less sharply to new tariff announcements than earlier in the year, when smaller emerging-market stocks were disproportionately affected as investors rotated into larger, lower-valued names and other perceived safe-haven assets amid heightened uncertainty.

EM Quality has Fallen Behind EM Value YTD

Source: Bloomberg, as of 30 September 2025. During the early-year volatility, we increased our exposure to existing high-conviction names and selectively added new names from our watchlist by taking advantage of attractive valuations and temporary dislocations from companies that we believe were unfairly impacted by broader market sentiment. With tariff related volatility likely subsiding, quality names, should now be better placed for a recovery.

The technology sector once again outperformed most other sectors globally, driving gains in both the US and China. Strong Q2 results from US hyperscalers and confirmation of continued large-scale AI capital expenditure reignited confidence in AI-led growth. To put this into perspective, the Guardian reported that Big Tech has invested more than $155 billion in AI this year2 — roughly equivalent to the cost of building the International Space Station. Meanwhile, policy support for domestic chipmakers and new AI product launches from China’s leading technology firms have fuelled a rally in Chinese and Hong Kong tech stocks.

Hyperscaler Capex Driving AI Momentum

Source: CL Taiwan, Daiwa. This strength in US and Chinese technology has also supported companies, including many in our portfolio, in emerging markets like Taiwan and South Korea which play vital roles in AI supply chains. For example, NVIDIA’s Rubin GPU rollout and rising ASIC volumes are boosting demand across the semiconductor supply chain, benefitting companies such as Elite Material, a global leader in high-performance copper clad laminates used in printed circuit boards. In its Q2 report, Elite announced an additional round of capacity expansion in 2026 due to strong demand, with revenue up 40% YoY. Other examples include Chroma raising its guidance for system-level testing revenue in light of rising demand from leading ASIC and GPU projects.

Other positive macro news for emerging markets comes in the form of the Federal Reserve’s first interest rate cut of the year this September, with rates now targeted at 4-4.25%. Fed officials also hinted that further rate cuts would follow in the remainder of the year. Lower US interest rates tend to benefit emerging markets by making lower yielding developed market assets less attractive, potentially prompting investors to seek higher returns in EMs some of which are also experiencing moderating local inflation, lower public debts and higher real rates. This can boost foreign direct investment and support EM asset prices. However, the impact is uneven, as greater risk appetite and lower US yields cannot fully offset weak macroeconomic conditions or poor corporate fundamentals in certain markets. Nevertheless, the continuation of the downward trajectory of global rate cuts should be positive for emerging markets overall.

Within our key markets, local factors are at play indicating the potential for country-level recoveries. Taiwan should benefit from the global AI momentum mentioned above with its global leadership in advanced semiconductors underpinning both industry demand and geopolitical importance. Korea should profit from a semiconductor recovery, as well as governance reforms and its Value Up initiative which is creating potential to unlock shareholder value by improving governance and capital allocation.

Meanwhile, India’s combination of fiscal prudence, resilient domestic consumption grounded in a young population, moderating inflation, and pro-growth policy support creates a constructive macro backdrop underpinning the country’s long term, high growth trajectory. In Brazil, while we expect volatility ahead of the 2026 elections, there is a clear path towards SELIC rate cuts and normalisation of real interest rates which would provide a catalyst for the Brazilian equities market.

China Rally Driven by Multiple Expansion, Not EPS Growth

Source: Macquarie. While China has dominated headlines this year with a strong market rebound placing it among the top-performing countries, we believe the rally has been driven primarily by sentiment and policy stimulus, rather than underlying fundamentals, as reflected in persistently weak economic data this quarter. The lack of a clear recovery in the real economy raises questions about the rally’s sustainability. Additionally, the rally has been largely concentrated in the tech sector which is now trading at less attractive valuations. For these reasons, we continue to exercise caution. We have been carefully screening the Chinese market across select sectors to identify companies that meet our stringent quality and governance standards. While only a few appear potentially aligned with these criteria, we remain disciplined and will continue our search without compromising on quality.

Overall, as we reflect on the year, we are reminded of Epictetus’ words: “It’s not what happens to you, but how you react to it that matters.” While this year has presented significant challenges, it has only strengthened our conviction in both our strategy and our portfolio companies. Rather than being discouraged by volatility, we used it as an opportunity to deepen our positions in high-quality, well-managed businesses.

By staying disciplined and true to our active, conviction-driven approach, we believe we are now well positioned to benefit from key macro, country and sector specific tailwinds over the coming years. Reflecting this confidence, the team has increased its investment in the strategy — a clear signal of our optimism about the future of our portfolio companies and the opportunities ahead in emerging markets which we intend to capitalise on.

-

Putting India Back in the Spotlight

While China’s equity rally has dominated headlines, in Global Funds Asia, Carlos Hardenberg highlights why India’s fundamentals, sustainable growth, and high-quality businesses deserve renewed focus.

Key highlights include:

Accelerating GDP growth: 7.8% in Q2 2025, more than double the global average.

Fiscal strength and investment: Infrastructure spending has doubled over the last decade, with a narrowing fiscal deficit.

Global resilience: Domestic consumption (60% of GDP) shields India from external shocks like tariffs.

Policy and inflation improvements: Easing inflation, rate cuts, and simplified GST reforms are driving confidence.

High-quality opportunities: Founder-led, well-governed companies in sectors like technology, industrials, and consumer goods.

Carlos concludes that India’s robust macro backdrop and unique position in emerging markets make it a standout long-term investment opportunity.

🔗 Read the full article here: https://fundsglobalasia.com/putting-india-back-in-the-spotlight/ [fundsglobalasia.com] -

Mobius Investment Trust Webinar October 2025

On 17 October 2025, the Mobius Investment Trust portfolio manager Carlos Hardenberg hosted a webinar on Investor Meet Company to help retail investors better understand the opportunities within emerging markets, as well as outlining MMIT’s differentiated approach to generating long-term capital growth across emerging markets.

-

Mobius Investment Trust Wins Prestigious AIC Shareholder Communication Award for Best ESG Communication

Mobius Investment Trust Wins Prestigious AIC Shareholder Communication Award for Best ESG Communication

London, 2 October 2025 – Mobius Investment Trust (MMIT) is delighted to announce that it has been named the winner of the Best ESG Communication category at the 2025 AIC Shareholder Communication Awards. This prestigious accolade recognises MCP’s innovative and impactful approach to communicating its environmental, social, and governance (ESG) strategy.

The awards, hosted by the Association of Investment Companies (AIC), celebrate exceptional shareholder communication among AIC member investment trusts and their managers. The judging panel, made up of industry experts including Anthony Leatham of Peel Hunt and investment journalists Moira O’Neill and David Stevenson, commended MCP for its original and engaging ESG communications approach.

MCP’s ESG strategy stood out for its transparency and sophistication, avoiding the repetition often seen in conventional ESG reports. The trust’s communications showcase how ESG integration drives stock-picking decisions, ensuring that ESG is not treated as a compliance exercise, but as a critical factor in generating sustainable returns for shareholders.

At the heart of MCP’s ESG efforts are its quarterly ESG factsheets, which provide clear, visually engaging updates on key ESG metrics and portfolio engagement activities. These factsheets highlight measurable progress, such as the significant improvement in environmental reporting from 58% in 2020 to 78% in 2025. Additionally, MCP has pioneered the integration of corporate culture into its ESG framework under the concept of “ESG+C(ulture),” recognising the importance of culture in driving performance.

Commenting on the award, Carlos Hardenber, Mobius Investment Trust Investment Manager said:

“We are honoured to be recognised by the AIC for our ESG communication efforts. This award reflects our commitment to transparency and innovation, ensuring that ESG reporting is not just informative, but also actionable and meaningful for our shareholders.”

For more information on our ESG strategy, visit the ESG section of our website.

-

Investment Week: Mobius Investment Trust’s Carlos von Hardenberg – Inside China’s great divergence

View article in Investment Week

This year, China has emerged as a tale of two sides.

On the one hand, economic data remains soft, highlighting ongoing challenges in the broader economy. On the other, equity markets have rallied, placing China among the top-performing countries year-to-date. Yet this momentum appears at odds with fundamentals, as gains seem driven largely by multiple expansion than earnings growth.

July’s economic data, released by the National Bureau of Statistics, missed consensus estimates, highlighting the problems inherent in China’s economy.

Continued weak domestic demand was evident in retail sales growing by just 3.7% YoY, down from 4.8% in June and marking the slowest growth in five months, while the ongoing property sector crisis was evident in property investments falling to -12% YoY from -11.2% in June.

Other indicators also disappointed: unemployment rose, bank loans shrank for the first time since 2005 and fixed asset investment slowed to 1.6% YoY.

Manufacturing exports rose 7.2% YoY, but this was largely due to exporters rushing shipments ahead of anticipated US tariffs. Industrial output grew just 5.7% YoY, down from 6.8% in June – the slowest pace since November.

This slowdown was partly due to adverse weather conditions as both unusually high temperatures and flooding disrupted factory activity and construction.

What is more, China’s producer prices fell by 3.6% YoY, marking the 34th consecutive month of producer deflation, highlighting China’s ‘involution’ problem, whereby fierce competition drives prices down, eroding margins and profitability.

E-commerce giants like Temu and AliExpress exemplify this dynamic.

To stimulate domestic demand, Beijing has introduced several measures. A home appliance trade-in scheme offers subsidies of up to 20%, now extended through year-end.

In July, annual subsidies of 3,600 yuan ($500) per child under three years were introduced to boost consumption and address demographic challenges. A one-year consumer loan subsidy programme begins in September, offering 1% interest subsidy on loans up to 50,000 yuan.

However, such subsidies offer only short-term relief and, once withdrawn, demand may falter, as they likely will not address deeper issues: low household confidence, especially with 70% of wealth tied to a declining property market and overcapacity in the private sector.

Monetary policy has also been accommodative. The People’s Bank of China cut the reserve requirement ratio by 0.5 percentage points in May and lowered key interest rates, injecting RMB 1trn in long-term liquidity. Yet the issue is not expensive loans – it is weak consumer confidence.

Bright spot

Now, let us turn to the bright spot – China’s stock market.

Chinese equities have outperformed the US and many global peers this year. The CSI 300 is up 17% while the MSCI China index is up 27% YTD in USD terms.

Within the MSCI China, communication services (+9.1%), consumer discretionary (+5.6%) and financials (+4.8%) have led the performance. The Hang Seng index is up 25% YTD in USD terms, with Hong Kong seeing a record $90bn inflow from the mainland H1.

This rally, despite weak macro data, seems to have been driven more by government intervention than earnings strength. State-backed equity purchases and a surge in corporate buybacks have supported prices.

Central Huijin Investment, a sovereign wealth fund, injected RMB 198bn ($28bn) in Q2, mostly into ETFs tracking the CSI 300. Announcements of anti-involution policies and further stimulus have buoyed sentiment. Higher liquidity from lower rates and high household savings, along with capital shifting from property to equities, has also helped.

On the company side, Chinese firms are delivering earnings per share (EPS) growth of around 10% YoY — the first time in seven years this aligns with expectations. However, revenues have been flat for nearly three years. EPS gains stem from margin expansion (non-financial net profit margins at 5.3%, near a 14-year high) and buybacks, which hit record levels in 2024.

Both drivers now show signs of fatigue: manufacturing overcapacity pressures margins, and buyback activity is slowing, raising concerns about the sustainability of earnings growth beyond 2025.

Although the trade war has caused periods of volatility, its impact on Chinese equities seems to have been short lived and relatively minor.

China has adapted by diversifying supply chains and tariffs have been less severe than feared – currently 30% versus Brazil and India at 50%. In fact, uncertainty has attracted foreign capital, boosting markets.

So, which side of China’s two tales will ultimately prevail?

So far, the stock market rally seems to have been driven more by sentiment, policy support and liquidity than by earnings growth or economic fundamentals. The absence of a clear rebound in the economic data raises questions about the rally’s sustainability.

The scale and effectiveness of policy measures going forward will be crucial. While past rounds of stimulus seem only to have had a limited impact on deflation and pricing pressures, larger stimulus could act as the driver for sustained market momentum.

Alternatively, investor disappointment in the measures taken, or their continued ineffectiveness, could be the trigger for a market correction.

-

RECORDING: MCP Investor Day 2025

For Professional Investors only

We were delighted to host our annual Investor Day in London on Tuesday, 23 September 2025, bringing together investors and portfolio companies for a day of discussion and insights. For those who couldn’t attend, please find the full recording below.

Highlights included insightful presentations from CarTrade, an Indian multi-channel auto platform provider, and TOTVS, a Brazilian software provider. CarTrade and TOTVS presented their respective businesses, provided an outlook for the coming years, spoke about their engagement with the MCP team, and showcased their innovation and structural growth within their respective industries.

This year’s key takeaways highlight favourable conditions for our portfolio looking forward, including easing tariff uncertainty, declining US interest rates, strengthening emerging market currencies, and accelerating investment in AI and technology supply chains. Additionally, strong results and constructive outlooks from many of our holdings should position them well beyond 2025.

For professional investors only. Capital at risk.

-

2 Reasons Why Emerging Markets Remain Attractive

Emerging markets have been hit hard by the latest wave of U.S. tariffs, with Chinese goods facing levies of up to 35% and India and Brazil up to 50%.

Yet, Carlos Hardenberg, investment manager at MCP Emerging Markets LLP, argues that “despite the current wave of global protectionism and escalating trade tariffs, emerging markets continue to offer compelling investment opportunities.”

He highlights two key factors underpinning their resilience: strong domestic demand and growing trade diversification.

View the full article in Investing.com