”The best time to buy quality stocks is now”.

Ruchir Sharma, Financial Times 01.12.2025

Dear Fellow MMIT Shareholder,

Since the inception of the strategy in 2018, our objective has remained unchanged: to deliver long-term performance by identifying high-quality, innovative, under-researched mid-cap compounders with strong fundamentals that are not represented in the benchmark. This disciplined investment philosophy has driven strong results over prior years, culminating in 35.2% outperformance against the MSCI EM Mid Cap Index in GBP terms by the end of 2024.

However, 2025 played out differently, despite emerging markets finally ending a decade of underperformance versus developed markets. The year proved challenging in relative terms for the strategy, as the market environment was particularly difficult for quality-oriented mid-cap stocks. Returns were increasingly driven by a narrow group of large, liquid companies and by style dynamics that ran counter to our investment approach.

That said, Q4 showed early signs of stabilisation and improvement. Over the quarter, MMIT’s net asset value returned 2.5%, while the MSCI EM Mid Cap Index (Net TR) delivered a return of 2.2% in GBP terms. This relative improvement was supported by solid operational performance across several portfolio holdings, with a number delivering results ahead of expectations.

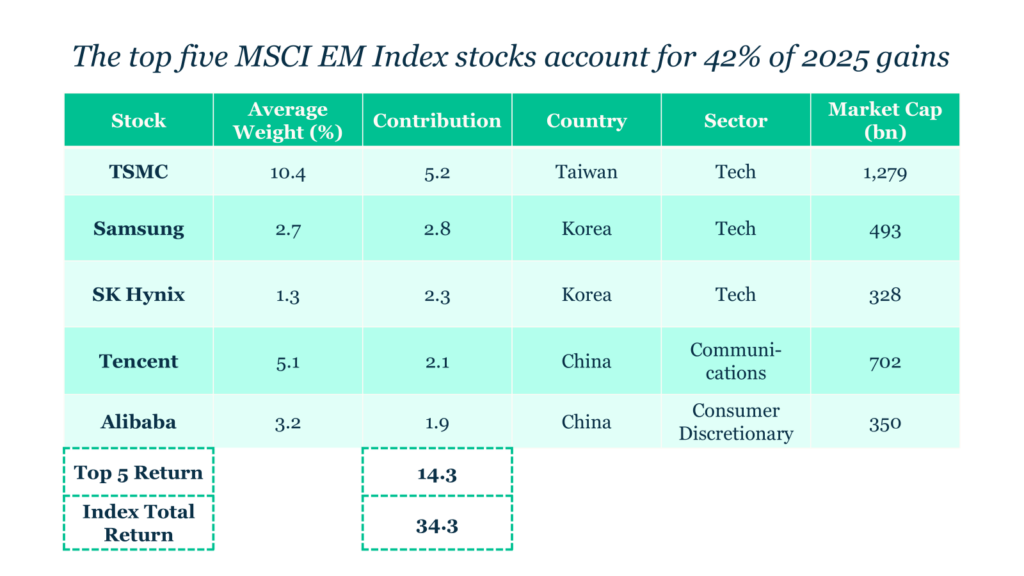

Emerging markets recorded steady gains over the quarter, finishing the year as the strongest-performing global equity asset class. As is often the case in the early stages of a recovery, initial inflows were concentrated in the largest and most liquid stocks. Within the MSCI EM Index, the top five holdings accounted for over 40% of total returns in 2025.

Performance in EM Driven by a Few Large Companies

Our investment universe is deliberately focused on lesser-known, under-researched small- and mid-cap companies across emerging markets, where we believe our bottom-up research adds the greatest value by looking beyond well-known benchmark constituents. The under-researched nature of this segment—typically marked by limited coverage, lower visibility and minimal benchmark overlap—can give rise to pricing inefficiencies that are largely absent in the highly efficient mega-cap space.

Active management is more likely to add value in these less crowded areas of the market, where returns are driven more by company-specific fundamentals than by index flows. Against a backdrop of unusually narrow market leadership, we believe this positioning may offer meaningful potential for relative catch-up as fundamentals reassert themselves.

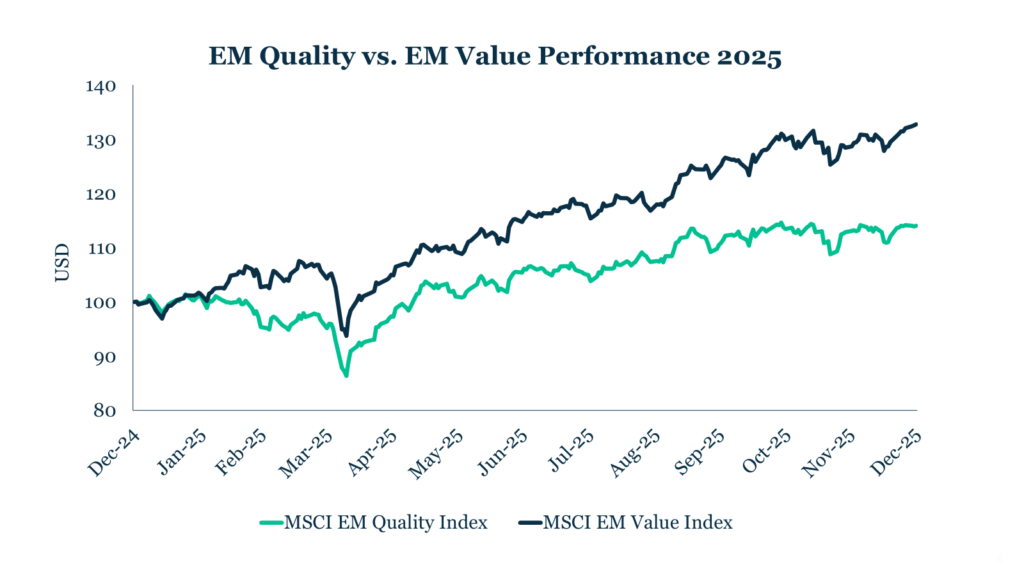

During 2025, the strategy’s emphasis on quality encountered significant style headwinds, with quality stocks—especially within emerging markets—suffering one of their worst periods of relative underperformance compared with the broader benchmark. Smaller companies, particularly growth-oriented businesses in the technology sector, were disproportionately affected by continued macroeconomic and geopolitical uncertainty.

Investor risk appetite remained constrained, with capital rotating towards perceived safe-haven assets such as gold and towards larger, more liquid equities viewed as more resilient in volatile markets.During this period, investors favoured sectors such as banks, commodities and defence-related industries, supported by higher interest rates, elevated fiscal and defence spending, and ongoing geopolitical tensions. This defence-led rotation provided relative support to parts of the industrials and commodities sectors.

These areas, which are deliberately excluded from the portfolio due to their regulatory complexity, capital intensity and limited pricing power, were generally trading at lower valuation multiples and tended to be more resilient during periods of market correction.

EM Quality Has Fallen Behind Value This Year

Additionally, China was a major contributor to emerging market performance in 2025, accounting for approximately 25% of MSCI Emerging Markets Index gains while representing around 23.6% of the index. However, we believe the rally has been driven primarily by multiple expansion, improved sentiment and policy support rather than an improvement in underlying fundamentals such as earnings growth.

Economic data remains weak, highlighting a disconnect between market performance and a meaningful recovery, and gains have been concentrated largely in the technology sector, where valuations have become less compelling. Structural risks also remain, including the potential for abrupt and unpredictable regulatory intervention, as experienced in 2021.

Against this backdrop, we continue to approach the market with caution, while remaining open to selectively deploying capital where individual companies meet our quality, governance and valuation criteria, without compromising discipline in pursuit of exposure.

Furthermore, performance was negatively impacted by our exposure to the software and IT services sector (19.3% in MMIT versus 1.8% in the MSCI EM Mid Cap Index as of 31 December 2025). The sector experienced tariff-related volatility, which led many corporates to delay discretionary IT spending decisions into 2026. As Gartner, a leading independent IT research and advisory firm, has noted, this resulted in “a business pause on net-new spending due to a spike in global uncertainty.”

Looking ahead, Gartner forecasts global IT spending growth of 9.8% in 2026. We view the recent weakness as cyclical, with recovery prospects supported by AI-driven demand and the resumption of previously deferred projects.

As a result of these factors, relative performance this year has not matched the strong returns achieved in prior periods. While disappointing, such outcomes are not unusual for strategies with a high active share. They are an inherent feature of a differentiated investment approach and a key driver of long-term results. Periods of softer relative performance have occurred in the past and have often been followed by improved relative outcomes as stock-specific fundamentals reassert themselves. This is reflected in the trust’s since-inception outperformance of 6.5% against the MSCI EM Mid Cap Index, despite the current year’s drawdown.

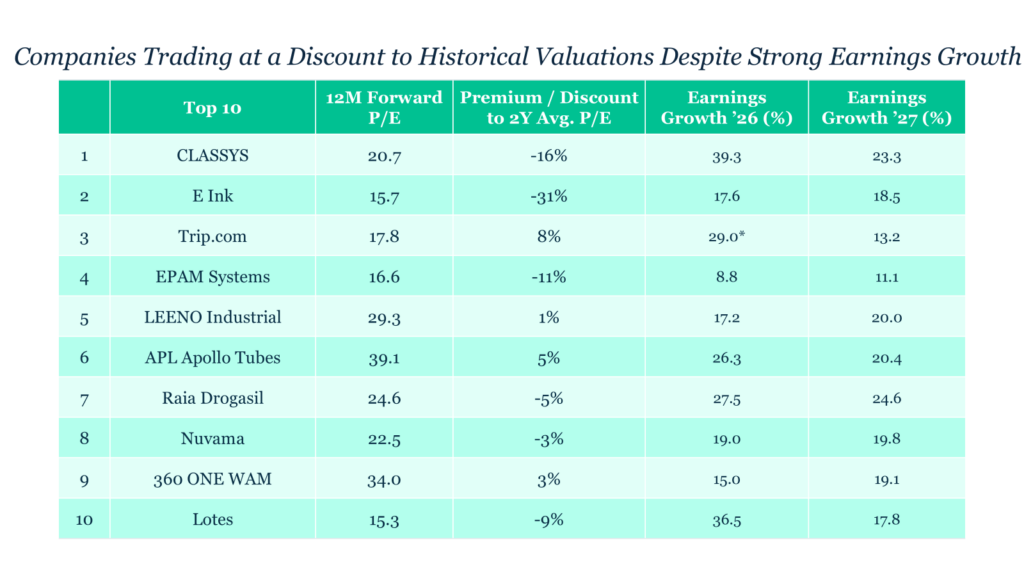

Active portfolio management remained central to the team’s day-to-day process throughout the year. We increased exposure to existing high-conviction holdings trading at attractive valuations following periods of volatility and selectively initiated positions from our watchlist, taking advantage of temporary share price dislocations in companies we believe were unfairly impacted by broader market sentiment.

This has allowed us to acquire high-quality stocks at discounts to historical valuations during one of the weaker periods of relative performance for quality companies in recent years. At the same time, we trimmed or exited positions where changes in the macro environment had, in our assessment, materially weakened the investment case.

Over the course of the year, we rigorously revisited every investment case, challenging attribution, portfolio exposures and our assumptions around earnings and valuation. Above all, we have remained committed to our investment philosophy. Our focus is unchanged: investing in high-quality, lesser-known, well-managed companies that compound value over time and align with our strategy and responsible investment principles.

Style Headwinds Have Driven Valuation Compression

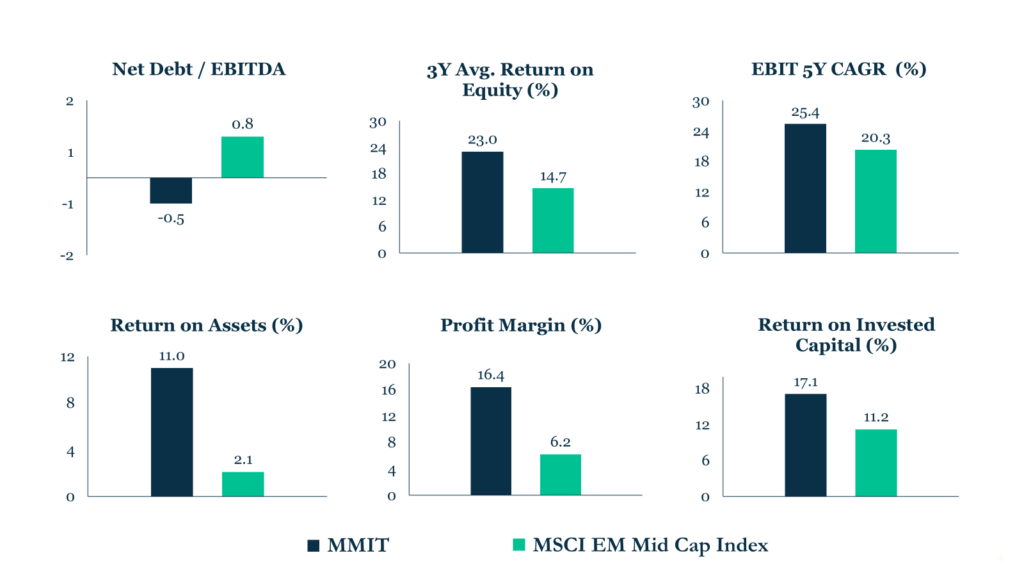

In this environment, the portfolio’s underlying fundamentals remain supportive. Market consensus forecasts a 23% forward EPS CAGR (three to five years) for the average portfolio company, supported by strong balance sheets and profitability, including a three-year average ROE of 23%, net debt/EBITDA of -0.5 and profit margins of 16%. In several cases, companies have delivered results ahead of expectations and seen earnings estimates revised upwards, yet share price performance has remained subdued.

MMIT Portfolio Offers High Growth and Profitability

Periods such as these—following a challenging year but characterised by resilient fundamentals and improving growth prospects—are often when long-term opportunities in high-quality businesses begin to emerge. In that sense, the conditions outlined throughout this commentary bring us full circle to the observation by Ruchir Sharma: “the best time to buy quality stocks is now.”

Leave a Reply