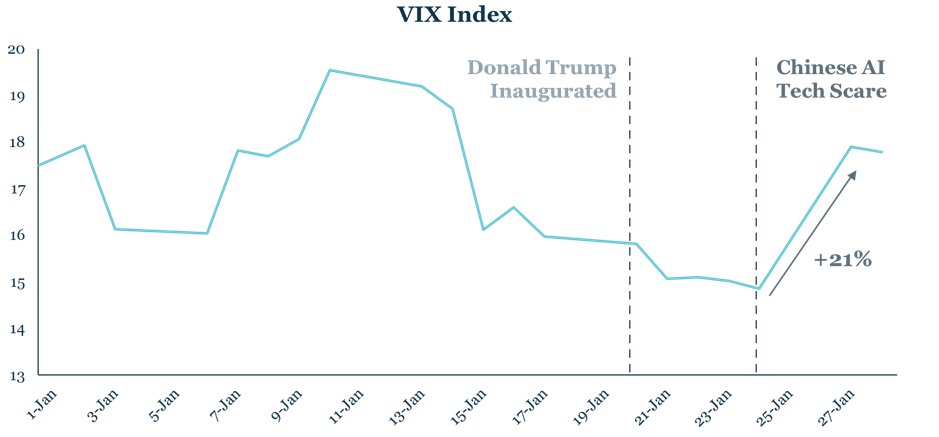

Yesterday, market volatility, measured by the VIX Index, jumped 21% from the previous trading day’s close. This spike was triggered by DeepSeek, a Chinese AI start-up, unveiling a large language model (LLM) reportedly built with just USD$6M, challenging the long-standing assumption that AI development requires vast amounts of expensive Nvidia chips. As a result, Nvidia’s share price dropped 17% on Monday with sell-offs reaching across U.S. big tech with other ‘Magnificent 7’ companies experiencing smaller, yet notable, declines.

This underscores the risks of a highly concentrated market where sell-offs can become more severe as many investors rush to offload the same stocks, leading to outsized losses for those who remain invested.

While the high concentration of the U.S. market is well-known, it’s less widely recognised that a similar dynamic exists in emerging markets. In the MSCI Emerging Markets Index, the top 10 companies make up roughly 25% of the total index weight despite having around 1,300 constituents. Additionally, many bulge-bracket EM funds are heavily weighted toward these top 10 names, potentially increasing their vulnerability to significant drawdowns during market sell-offs.

This highlights the importance of portfolio diversification. Instead of over-concentration in a few dominant players, MCP focuses on smaller, innovative companies in emerging markets, particularly in sectors like AI and the semiconductor supply chain as well as those catering to the global recovery in consumer demand. These are areas we believe have strong potential to generate alpha and provide long-term growth opportunities.

Leave a Reply