Over the past 15 years since the Global Financial Crisis, the United States Dollar (USD) has strengthened significantly, particularly against emerging market currencies, leading to widespread undervaluation compared to historical averages. Many 2025 market outlooks anticipated further USD gains, driven by so-called Trump Trades, with investors expecting sectors that benefit from tax cuts, deregulation, and protectionism to outperform.

However, these market forecasts were soon proven wrong as Trump’s erratic policies regarding tariffs has resulted in the weakening of the USD this year, giving rise to doubts about its continued long-term strength. At MCP, we believe the undervaluation of EM currencies compared to the USD presents attractive opportunities for investors.

What Does EM Currency Undervaluation Mean for Investors?

EM currency undervaluation provides key investment opportunities to capitalise on additional sources of alpha when the currencies re-rate and gain ground; a trend that has gained momentum this year. Brazil is a key example – the Brazilian Real (BRL) has appreciated 10% against the USD YTD as of the 31 July – a welcome contrast to the BRL’s 27% depreciation in 2024. Key drivers behind the Real’s appreciation include improving fiscal conditions, positive economic data, and successive hikes in its benchmark interest rate (the Selic), which currently stands at 15%, helping to stabilise inflation expectations.

While currencies can present opportunities for additional sources of alpha, we are conscious that they can also become significant detractor to returns. That is why currency risk will always remain a key consideration in our vigorous macro-overlays. Additionally, while we do not invest based solely on currency attractiveness, it can contribute to the broader investment case for a high-quality, attractively valued stock.

In countries with more vulnerable currencies, we mitigate risk by focusing on companies with diversified currency exposure. We particularly favour exporters generating revenue in hard currencies. For example, CI&T is a software company based in Brazil which caters to the US market, generating more revenue in USD than in real, while in Turkey, Hitit, an airline and travel IT Solution provider, generates 65% of its revenues in USD and 13% in EUR.

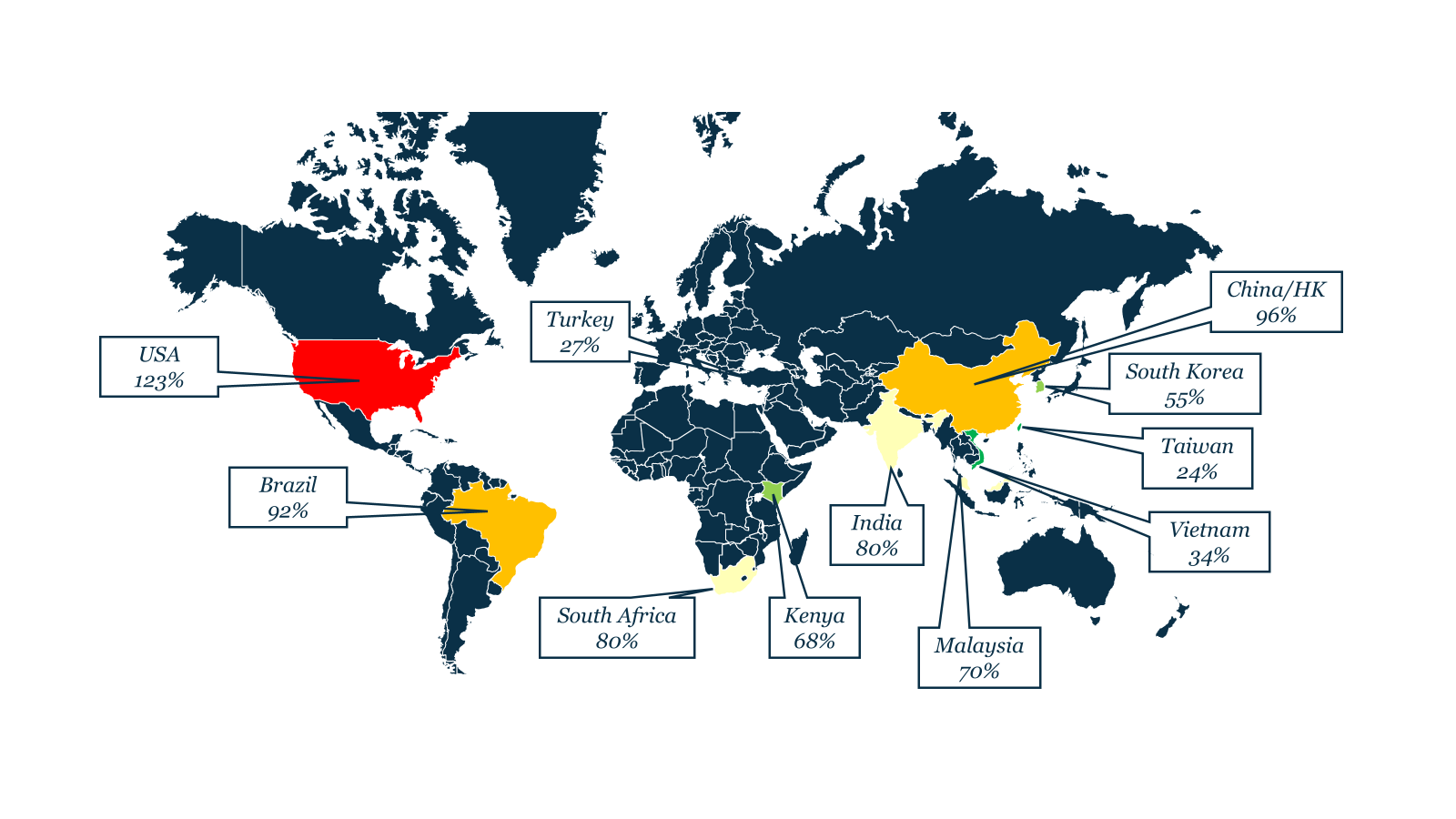

So how undervalued are EM currencies?

There are several factors suggesting that that emerging market currencies may be due for a reversal in their long-standing depreciation trend, a view increasingly supported by foreign exchange movements this year.

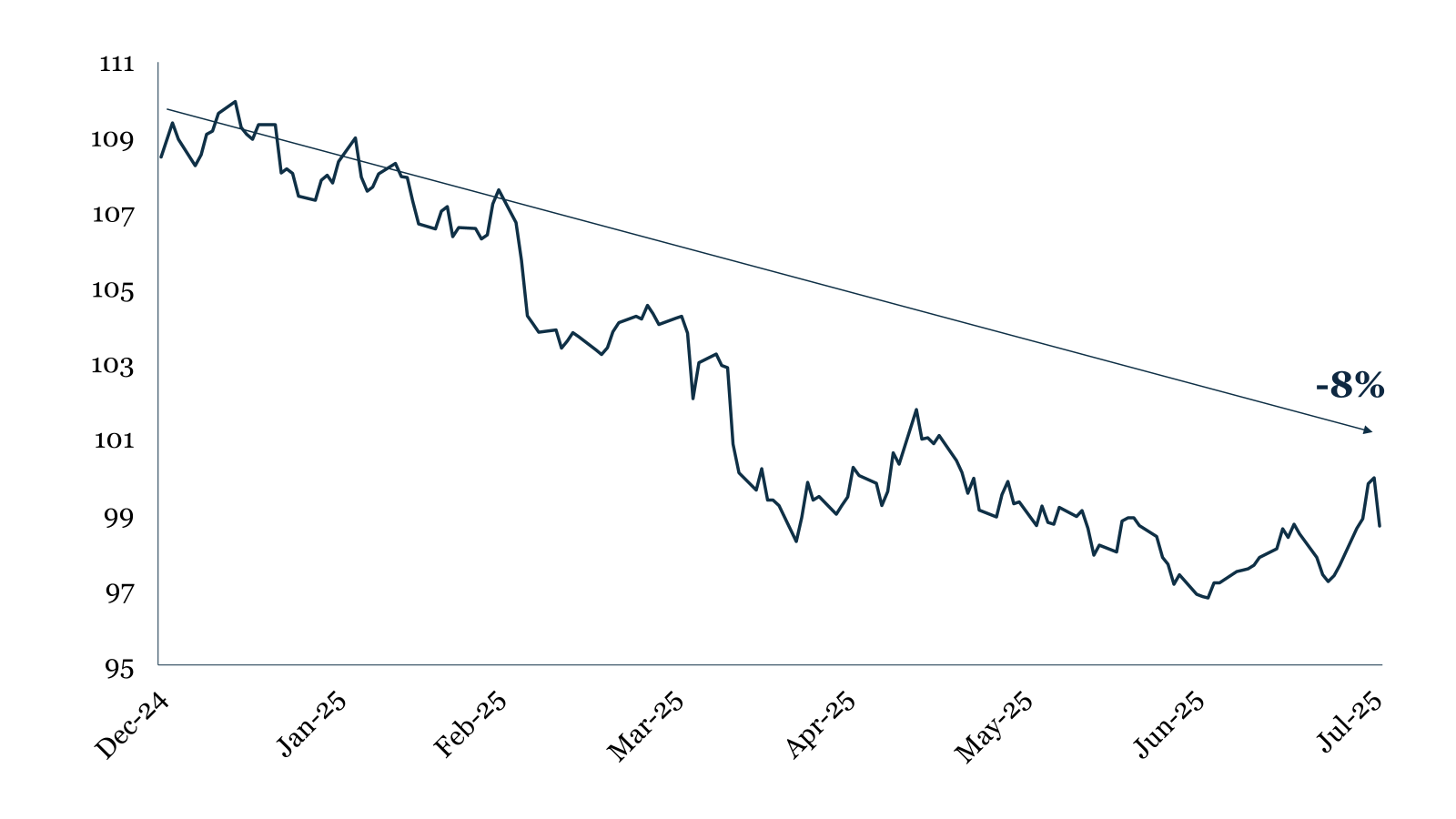

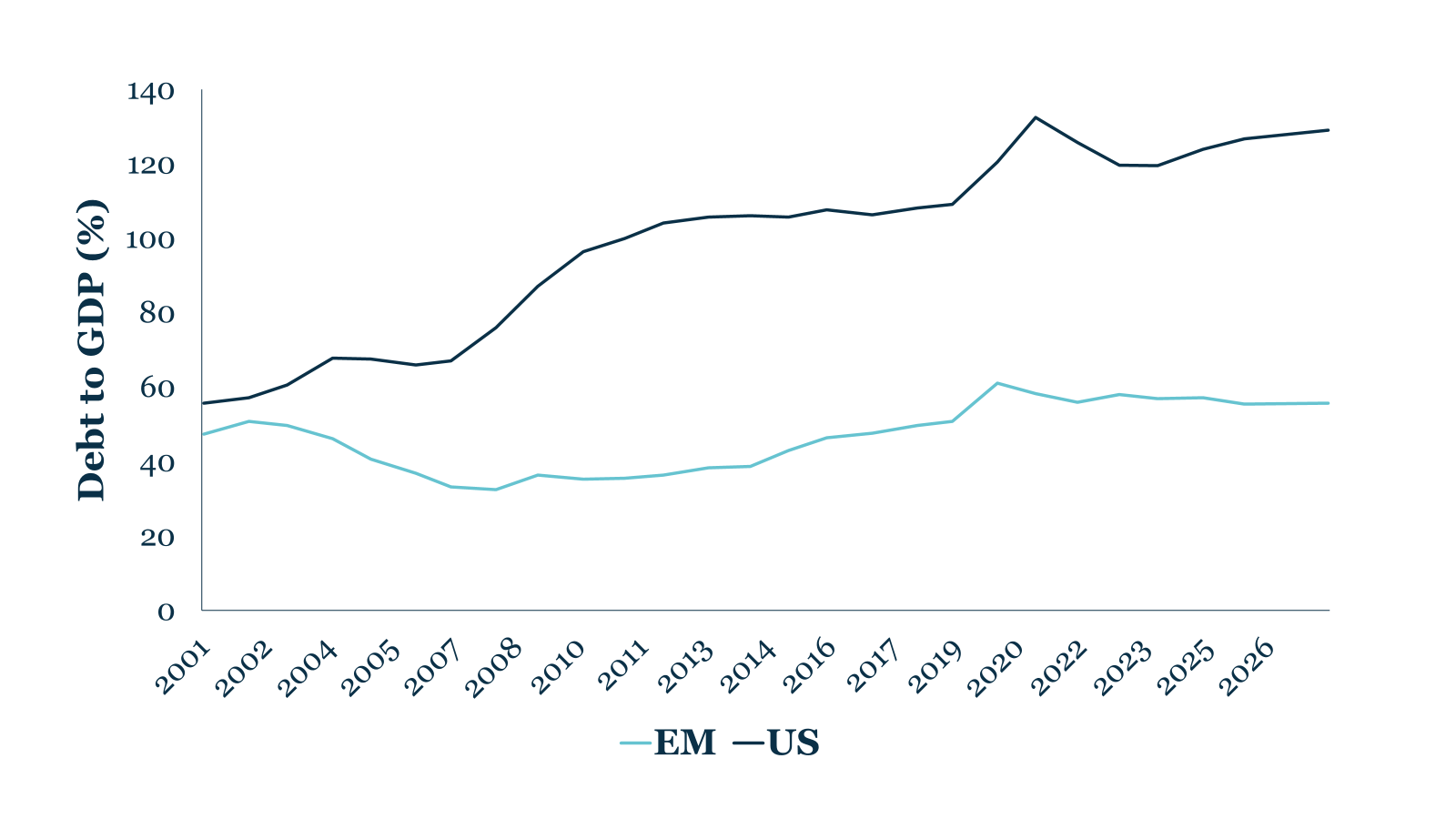

Firstly, the USD ended 2024 at two standard deviations above its 50-year average. Given the cyclical nature of currency markets, this suggests limited room for further appreciation[1]. In 2025 so far, the dollar has already retreated from its post-election highs, as market sentiment has turned increasingly negative towards Trump’s policies, fuelling concerns about a revival in inflation. This, coupled with an increasing fiscal deficit and mounting federal debt, has caused investor confidence in the US economy to decline.

USD Spot Index YTD

The long-standing narrative of ‘American Exceptionalism’ that has driven US equity market dominance in recent years is beginning to unwind. In response, capital is increasingly shifting toward more globally diversified asset classes. Notably, emerging market portfolio inflows reached $42.8 bn in June according to data from the Institute of International Finance.

Should Trump’s erratic and inflationary policies continue, this erosion of trust in US institutions could become more permanent. Signs of this shift are already emerging, demonstrated by Moody’s downgrade of the US credit rating from AAA to Aa1 due to concerns around US debt.

EM Debt has Remained Steady This Decade Compared to Soaring US Debt

Many Emerging Markets Have Healthier Debt-to-GDP Ratios than the US

as percent of GDP.

Globally, countries appear to want to move in only one direction: away from economic dependence on the US, including reducing their reliance on the US dollar. This is evident in the growing efforts of many countries to settle a larger share of their trade in domestic currencies. For example, in 2022 the Reserve Bank of India set up a trade mechanism to facilitate bilateral trade in Indian Rupee.

Adding further support to potential EM currency appreciations, global interest rates are on a downward trajectory. Although Trump’s policies may slow the pace of Fed rate cuts—despite his clear preference for looser monetary policy—the structural trend remains intact. Historically, a declining rate environment has supported EM currencies, given their inverse correlation with the USD. Lower US rates reduce the burden of dollar-denominated debt, easing external financing conditions for emerging markets.

Meanwhile, if EMs manage their own inflation effectively and maintain credible monetary policies, their currencies should strengthen as investor confidence shifts toward higher-yielding and well-managed EM economies. Notably, some of the strongest EM currency performers this year include the Brazilian real, Taiwanese dollar, South Korean won, and Malaysian ringgit.

We do not expect EM currency appreciation to occur uniformly across all EMs as each is shaped by its own unique mix of internal and external pressures. However, in cases where currencies do appreciate—especially those supported by strong structural reforms and credible institutions—the outcome can be meaningful alpha generation, as illustrated by Brazil this year.

[1] JP Morgan

Leave a Reply