Dear fellow MEMF shareholder,

Throughout the past quarter—and indeed the entire year—we have experienced significant market volatility, driven in large part by shifting U.S. trade policies under the Trump administration, which have fuelled considerable uncertainty. Volatility peaked following the 2 April announcement of extraordinarily high, sweeping ‘reciprocal’ tariffs. This announcement shocked global markets, triggering sharp selloffs with some of the steepest price movements in decades. The subsequent pause of the tariffs to 9 July seemed only to confirm the erratic nature of U.S. policies, a sentiment further validated by the recent extension to 1 August.

Meanwhile, geopolitical tensions—including the ongoing war in the Ukraine and the escalating conflict in the Middle East—have added further layers of complexity to the global macro environment. Several emerging markets have faced their own significant challenges: India experienced a sharp market downturn in January and February; South Korea continued to navigate political instability following last year’s failed attempt to impose martial law; and Turkey came under renewed pressure after the arrest of President Erdogan’s main opposition leader. Finally, the surprise release of the Chinese chatbot DeepSeek introduced unexpected competitive dynamics in the global AI landscape, further unsettling investor sentiment.

Smaller, high-quality companies, particularly in the technology sector, were disproportionately affected by the uncertainty as investors fled to safe heaven assets like gold but also to the larger, more liquid names deemed to be less risky. Furthermore, amidst the volatility, we observed a market rotation into sectors such as banks and commodities. These areas, which we deliberately exclude from the portfolio due to their regulatory complexity, capital intensity, and limited pricing power, had already been trading at low valuations and therefore proved more resilient during recent market corrections.

Our portfolio is benchmark-agnostic, with an active share close to 100%, reflecting our high-conviction, bottom-up stock selection. While this naturally leads to periods of return divergence against the broader market, we believe it positions us well to deliver meaningful long-term outperformance.

We’ve navigated challenging periods before, such as in 2019 and 2022, and in both instances, the fund went on to deliver strong (out-)performance in the years that followed. As the dislocation begins to correct, MEMF’s NAV has started to recover, delivering 11.8% (Private C Founder USD) and 2.7% (Private C Founder EUR) terms over the quarter. Since inception, the fund has delivered a return of 49% (Private C Founder USD).

We viewed the recent market pullback as an opportunity to further strengthen the portfolio. We selectively added high-conviction names from our watchlist, taking advantage of attractive valuations and temporary dislocations. Active portfolio management has remained central to our day-to-day work: we trimmed or exited positions where, in our view, the macro environment had materially weakened the investment case and redeployed capital into more compelling opportunities. At the same time, we increased exposure to several high-conviction holdings that had been unfairly impacted by broader market sentiment. Encouragingly, many of our portfolio companies delivered strong Q1 results, with several beating expectations and issuing positive forward guidance, despite ongoing uncertainty.

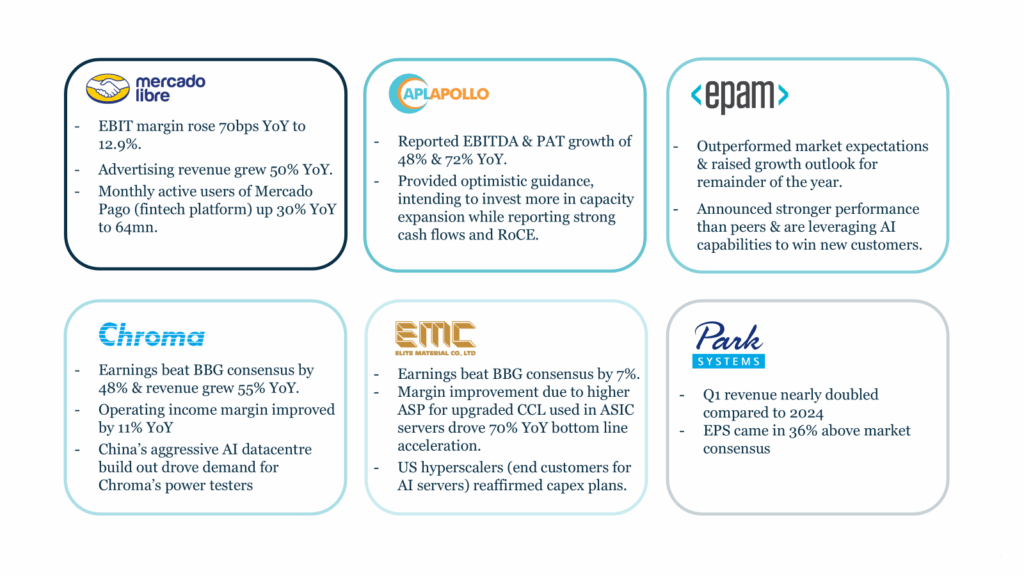

Strong Q1 Results, Optimistic Outlook for 2025 & Beyond

Past performance is not a guide to future performance.

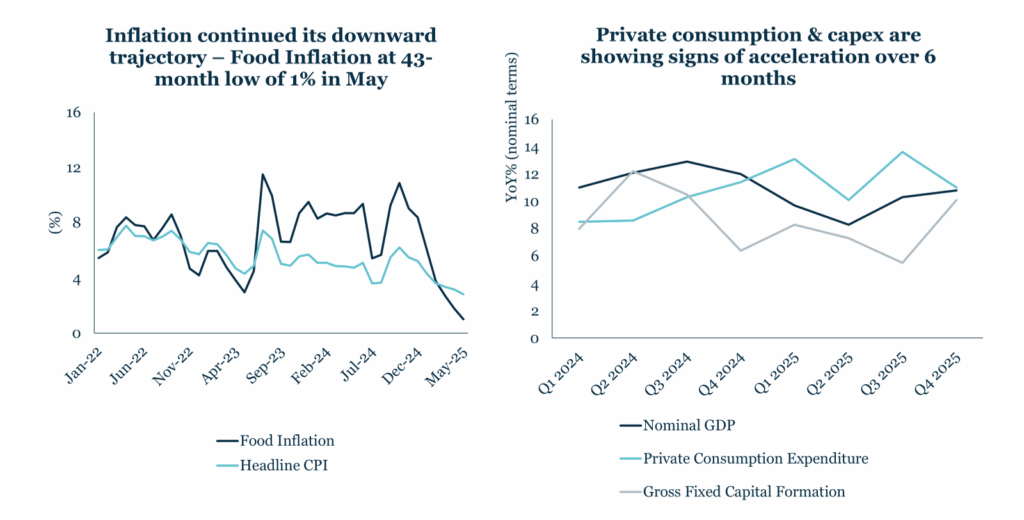

Our extensive on-the-ground research this year—spanning visits to Taiwan, India and Korea—provided valuable insight and generated a number of promising new ideas. India stands out as a particularly strong focus for us. We took advantage of market weakness earlier this year to add undervalued names, supported by an improving macro backdrop that includes rate cuts, easing inflation, and increased liquidity in the banking sector.

Economic Indicators Point to Continued Recovery in India

In Korea, the outcome of the 3 June elections brought political stability, which has boosted stock performance. The new government is pursuing a broad agenda of market-friendly reforms, not only to tackle the longstanding ‘Korea discount’, but also to enhance overall corporate governance, capital efficiency, and investor confidence. As a result, new opportunities are emerging, particularly in the technology sector. Brazil has also remained on our radar, with compellingly low valuations, improving macro fundamentals, and a strengthening real contributing to a more constructive outlook.

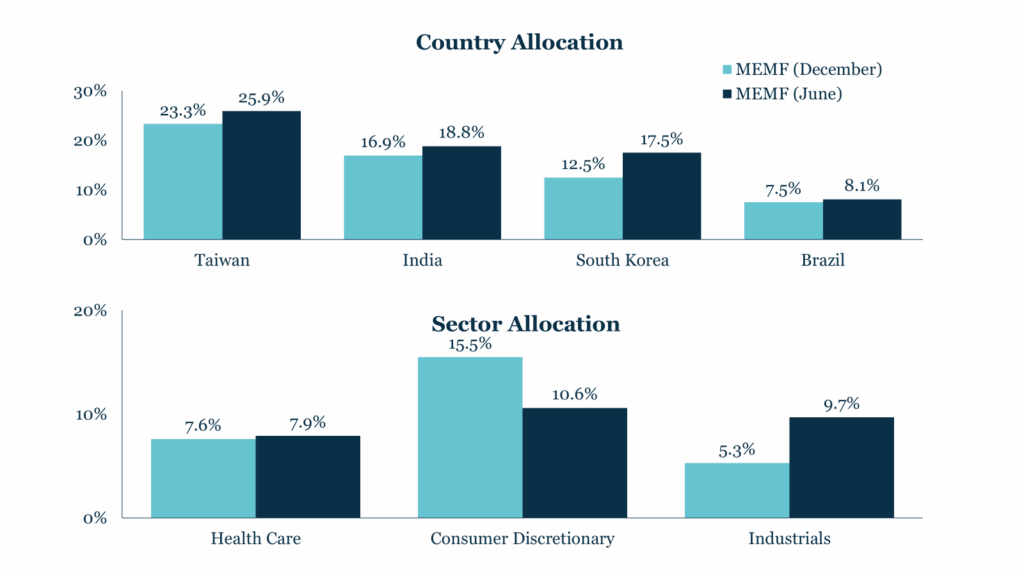

From a sector perspective, we have been active as well. In health care, we began reducing our position in Korean medical aesthetics company Classys after realising significant profits over the course of the holding period. In industrials, we added to APL Apollo and bought KEI Industries in India to capitalise on Indian infra and energy capex demands.

In consumer discretionary, we added CarTrade given its dominant position in car classifieds in India catering towards local consumption growth. We remain bullish on the technology sector; however, the composition of our tech holdings has been thoughtfully realigned to reflect our evolving views amid current macroeconomic challenges, broader market trends, and shifting IT spending priorities.

Country/Sector Allocation Changes YTD

MEMF (June): as of 30 June 2025.

After the ‘DeepSeek scare’—when a Chinese artificial intelligence start-up launched a high-performing model at lower cost—first-quarter results from Amazon and Alphabet confirmed strong momentum in artificial intelligence investment. Businesses are rapidly shifting to artificial intelligence-driven models, requiring continued large-scale investment in computing infrastructure.

Encouragingly, many of our portfolio companies in the technology sector echoed this trend in their Q1 earnings reports, providing constructive guidance for the year ahead and pointing to an emerging rebound in demand, driven by renewed strength in AI-related spending.

For example, Chroma, a Taiwanese supplier of testing equipment, beat Bloomberg earnings consensus by 48% driven by a 11% increase in operating margin year-on-year, and a 55% year-on-year revenue growth. Demand for Chroma’s power testers was supported by China’s aggressive AI datacentre build out, and the company’s outlook remains constructive for the rest of the year as it is entering a leading foundry’s packaging supply chain with a customised metrology tool.

Meanwhile, Elite Material (EMC), the global leader in high-speed copper-clad laminates (CCLs), reported earnings 7% ahead of Bloomberg consensus. EMC’s tailwinds came from strong demand for higher-priced CCLs, predominantly used in Application-Specific Integrated Circuit (ASIC) servers, which drove a 70% YoY bottom line acceleration. The reaffirmation of US hyperscalers’ (the end customers for AI servers) capex plans has reinforced EMC’s positive outlook.

The careful refinement of the portfolio has culminated in a deliberate and focused consolidation into 29 high-conviction holdings—companies we believe are best positioned to deliver sustainable, long-term growth. This portfolio is testament to our continued focus on high-quality businesses with deep moats and a strong orientation toward innovation. Throughout periods of market volatility, we have remained disciplined and patient, staying true to our convictions and executing the strategy we set out.

While we monitor macroeconomic developments closely, we adjust our positioning only when we believe such shifts materially affect a company’s long-term investment case. Underscoring our confidence in the strategy, the team increased its own commitment to the fund during the recent market pullback—demonstrating strong alignment with long-term shareholders. Much like the rebounds that followed challenging periods in 2019 and 2022, we view 2025 in a similar light. With improving visibility into the remainder of the year, we believe there is good potential for continued recovery, despite ongoing volatility and near-term challenges.

Outlook

Looking ahead, U.S. trade policies continue to inject a persistent sense of uncertainty and volatility into the economic outlook for the coming months. The initial 90-day reciprocal tariff pause—subsequently extended by an additional month—was designed to create space for the U.S. to negotiate new trade agreements. Yet, progress has been limited. To date, only the United Kingdom, Vietnam, Indonesia and China – though limited in scope – have reached accords, highlighting the limited effectiveness of a strategy centred around economic pressure.

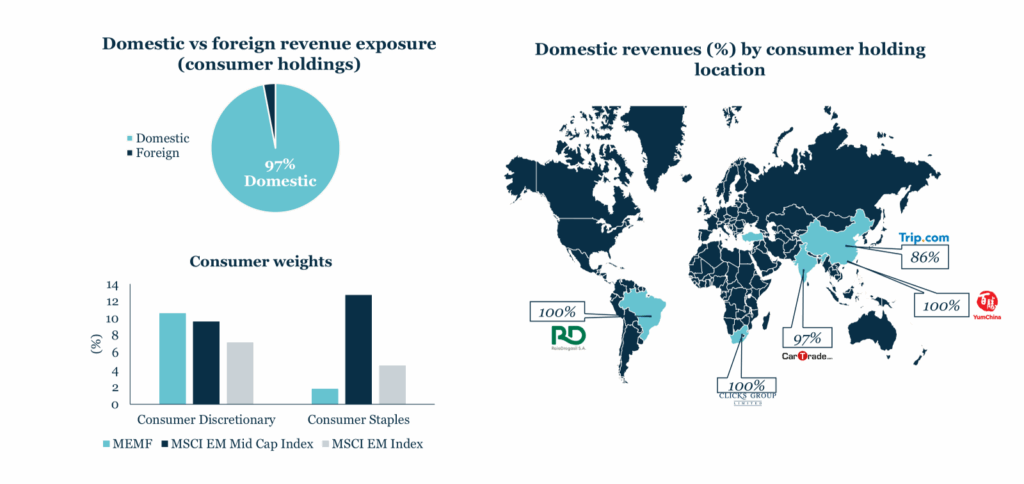

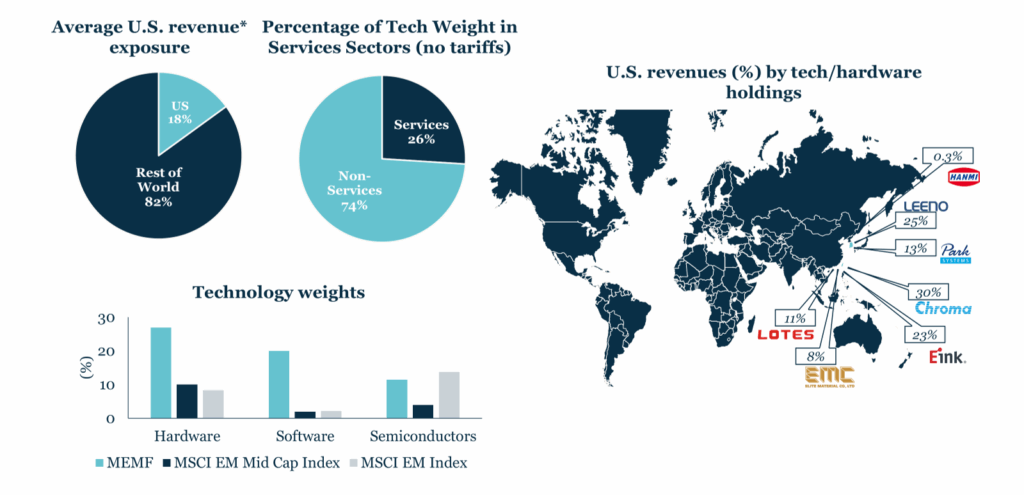

We continue to monitor the potential impact of heightened tariffs on our portfolio. However, direct exposure seems to be modest. Firstly, a large portion of our technology exposure is based in the software-as-a-service industry, and as services, these are not subject to tariffs.

Secondly, our remaining tech holdings, primarily in the semiconductor and hardware sectors, which are largely currently exempt from tariffs, generate only a limited share of their direct revenue from the U.S. market.

Thirdly, we favour business models oriented towards domestic consumption in select geographies, such as India, which similarly have minimal direct exposure to the U.S. Nonetheless, we continuously monitor the potential broader impact of the seemingly erratic U.S. policies on our portfolio.

MEMF Consumer Exposure Skewed Toward Domestic Demand

MEMF Tech Holdings Show Low Direct Exposure to the U.S.

More broadly, the U.S. may be absorbing greater-than-expected fallout: rising inflation, weaker growth and confidence, and a softening dollar suggest a reversal in the decade-long USD strength—potentially a tailwind for emerging markets. With EM inflows rebounding ($19.2bn in May, tracked by the Institute of International Finance (IIF)), and a shift away from concentrated U.S. exposure, we believe our portfolio is well positioned to benefit.

Leave a Reply