Last February, we published an article outlining South Korea’s newly announced Value Up Program introduced by the Financial Services Commission (FSC) together with the Korea Exchange (KRX). The program was designed to tackle the ‘Korea Discount’, whereby Korean equities trade at significantly lower valuations than to their global counterparts.

At the time of writing, the program’s specifics were limited. It was understood that it would comprise a set of voluntary guidelines encouraging companies to devise mid- to long-term targets to increase shareholder value. Companies participating in the program would receive substantial financial incentives. In addition, companies with a proven track record of profitability or those that were expected to boost valuations would be included in the upcoming Korea Value-up Index, with ETFs tracking the Index to be launched in Q4 2024. In fact, all four of our Korean holdings have been included in the Index.

Despite the program’s ambitious aims, initial reactions were cautious, with concerns raised about the lack of detail, particularly regarding the unspecified tax incentives that the FSC emphasised as a key reason to participate. In response, the FSC promised to release more concrete guidelines by June 2024.

A year on from the program’s launch, we believe it is timely to revisit the initiative to shed light on the more detailed framework that has since been released and to offer an assessment of its early successes and failures.

What Further Details Have Been Released?

The Corporate Value Up Program:

In May 2024, the FSC released their guidelines for the Value Up Program, which were published in full on their website in August. The guidelines recommend that companies’ Value Up plans include information from six key categories.

1. Company overview

Corporate information should be specified to provide a comprehensive description of the company, including business sectors, major products and services and company history.

2. Current status analysis:

Companies should disclose the most relevant financial indicators for medium- to long-term value improvement specific to their industry. These may include price-to-book ratio (PBR), price-to-earnings ratio (PER), return on equity (ROE), return on invested capital (ROIC), dividend payout ratio, shareholder return ratio, revenue growth, and so on. In addition, non-financial indicators, most significantly those related to corporate governance, are encouraged to be disclosed.

3. Goal setting:

Companies should set goals for improving their disclosed metrics to enhance corporate value in the medium- to long-term. These goals may include expanding R&D, investing in human and physical resources, efforts to increase shareholder returns, such as the cancellation of treasury stocks, and so on.

4. Planning:

Detailed plans should be submitted regarding how these goals will be achieved.

5. Implementation evaluation:

It is recommended that plans are submitted once a year, alongside a review of the previous year’s achievements.

6. Communication:

Companies should submit a report on the status, plans and performance of their communication, including quantitative methods for promoting effective communication, such as English translations of their Value Up plan.

The KRX commenced its first Corporate Value-up Award Program on 27 May, recognising and awarding companies with notable value-up achievements. In a prior press release the FSC stated that awarded companies will be eligible to receive (a) an exemption from the external auditor designation requirement, (b) a mitigation in penalties resulting from an audit review, (c) an exemption from KRX listing fees and annual dues, (d) an exemption from fees related to making changes to KRX listing status, and (e) a six-month postponement of sanctions resulting from dishonest disclosure.

The KRX plans to provide a range of services to support companies’ voluntary disclosures. These services will include disclosure-related training, providing information on the program to internal and external company directors, and offering one-to-one consulting services to support small and medium-sized businesses that may lack the human resources and physical infrastructure to develop and disclose their Value-up Plans independently. According to the KRX, it provided this consultation service to 55 companies in 2024, including nine from the KOSPI and 46 from the smaller KOSDAQ Index. The KRX plans to increase the number of consultations in 2025, offering the service to 50 KOSPI and 70 KOSDAQ companies. Priority will be given to companies that plan to participate in the Value Up Program.

The Korea Value Up Index:

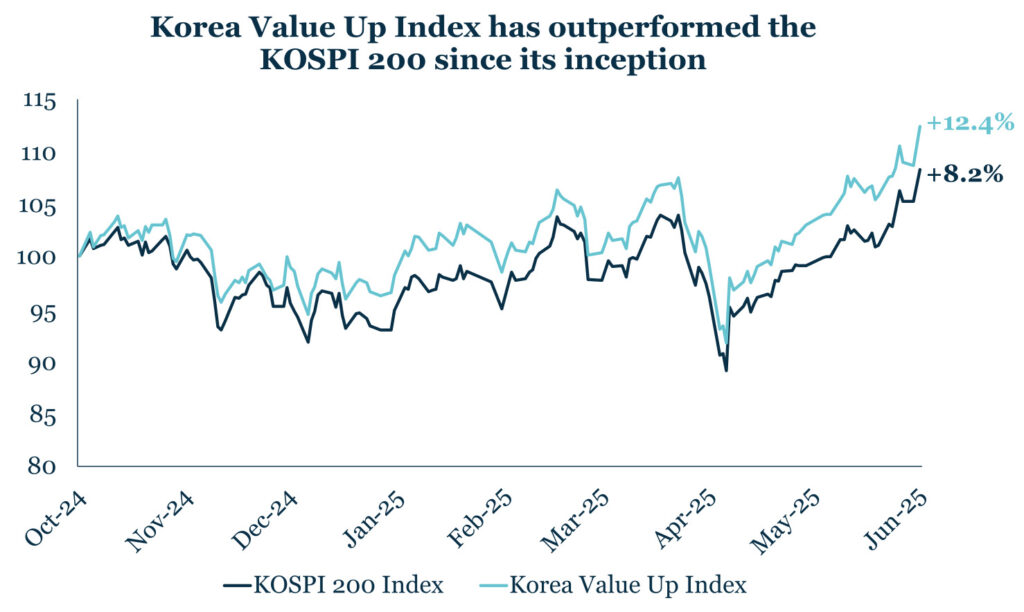

Details of the Korea Value-up Index were released in September 2024, with ETFs tracking the index becoming live in December. The index comprises 105 companies listed on the KOSPI or the KOSDAQ, with the majority listed on the former. The Index is intended to serve as a benchmark for pension funds and institutional investors to help them identify companies with higher shareholder value.

Selection for the Index is based on criteria such as profitability and shareholder return, including dividends, share buybacks, price-to-book ratio and return on equity. Moreover, the KRX has adopted a relative evaluation method in order to account for differences across industry characteristics thereby ensuring sectorial balance.

The Korea Exchange announced the first rebalance of the Index on 27 May 2025, adding 27 new stocks and removing 32. Changes reflect the preferential inclusion of companies actively disclosing Value-Up plans and the removal of those that have undertaken actions which may have harmed shareholder value or are not in line with the policies of the Value Up Program. The actual rebalancing was implemented on 13 June. We are pleased to announce that all four of our Korean holdings have retained their place on the Index, reflecting their commitment to high shareholder return and strong corporate governance in line with the goals of the Value Up Program.

What are the Program’s Early Successes?

So, what—if anything—has the Value Up Program achieved in its first year? According to the FSC and the KRX, 125 companies had officially disclosed their Value Up Plans by the end of March 2025. While this represents only 5.1% of all listed firms on the KOSPI and KOSDAQ, these companies together account for 46.1% of total market capitalisation[1]. The Korean business news outlet, Chosun Biz, reported that, encouragingly, between the second quarter of 2024 and the first quarter of 2025, listed companies repurchased 22.88 trillion won worth of shares, a 2.4x YoY increase. Stock cancellations reached 19.59 trillion won, up 2.3x YoY, while cash dividends rose by 11% to a total of 48.35 trillion won. These developments suggest that early adoption of the program may already have translated into tangible changes in corporate behaviour.

Although the number of participating companies remains relatively low, momentum is said to be building as major Korean conglomerates, known as ‘chaebols’, begin to show increased interest. Hyundai Motor has already announced new targets for total shareholder return and share buybacks as part of its commitment to the initiative. LG and Posco are expected to join the program too. The Financial Times reported Jeong Eun-bo’s, Chief Executive of the KRX, argument that once Korea’s largest companies join the program, over time, it will encourage other companies to join due to Korea’s strong naming and shaming culture.

Additionally, Kim Byoung-hwan, Chairman of the FSC, has stressed that the program’s effectiveness should be evaluated in the long-term, acknowledging that shifts in corporate culture, particularly those involving governance and capital allocation, are always gradual. We share this view: the Value Up Program is a long-term structural reform initiative, designed with a decades-long horizon in mind. Japan’s own corporate reform efforts, which started over a decade ago and have only recently begun to bear fruit, demonstrate that such deep-rooted changes require a long-term strategy and perspective.

What are the Program’s Early Shortcomings?

The main criticism of the program is that it is voluntary. While 125 companies have joined, some argue that this figure is underwhelming. Whether this level of participation is significant or not ultimately depends on one’s perspective, but it is clear that the number would be higher with more enforceable guidelines or legislative obligations. Given the seriousness of the ‘Korea discount’, including the fact that the National Pension Fund is projected to be depleted by the 2050s due in part to the low valuation and growth of domestic stocks, the program’s non-compulsory nature seems misaligned with the scale of the problem. From this standpoint, many argue that the program should be mandatory to ensure companies are held accountable for delivering shareholder value and improving market efficiency.

Critics also highlight that the program falls short of addressing deep-rooted structural issues in Korea’s corporate environment. With inheritance tax rates as high as 50–60%, families are incentivised to suppress corporate valuations to mitigate future tax burdens on the next generation. Furthermore, the program does not prevent the opaque and complex cross-holding structures that many large Korean conglomerates rely on to maintain majority control, which in turn allow the interests of minority shareholders to be disregarded. Therefore, even if the program raises valuations to some extent, it is not until the conflicts of interests between the large corporations’ self-interests verses boosting shareholder value are aligned that the ‘Korea discount’ can truly be tackled for good.

What is the Future of the Program?

As it stands, the FSC has no plans to transition the initiative from a voluntary framework to an enforced one. This means that the program’s long-term success will depend on whether more companies choose to participate willingly. In turn, this will likely require additional regulatory activity and structural reforms to overcome entrenched disincentives.

The direction of the program may be significantly influenced by political developments. Following the impeachment of President Yoon Suk Yeol, resulting from his failed attempt to impose martial law, early elections were held on 3 June 2025 with Lee Jae-myung of the Democratic Korea Party (DKP) winning the election.

Lee has publicly committed to addressing abuses by controlling shareholders and promoting better governance in support of the Value Up Program. Notably, in March 2025, the DKP succeeded in pushing through a revision to the Commercial Act, aimed at expanding the fiduciary duties of board members. The revised law would require directors not only to act in the company’s interest but also to protect minority shareholders and promote board independence. However, the PPP under acting president Han Duck-soo vetoed the amendment on the basis of over regulation. While this has blocked the amendment, the DKP’s clear willingness to push through such reforms demonstrates a strong commitment to structural change and addressing corporate governance issues. Furthermore, with the DKP now in power, the legislation could be revived.

By following the regulations the new government prioritises during their initial period in office, we will soon have a better idea of the future of the Value Up Program. We will continue to closely monitor these developments, as well as any other relevant regulatory changes within Korea’s political landscape. Nevertheless, we believe that the Value Up Program is an important starting point for the country’s development towards higher valuations and better corporate governance. At the very least, the program has sparked conversations and drawn attention to these structural issues, which require the attention of both the corporate and political leaders of Korea for the long-term health of the country and its market.

[1] Chosun Biz

Leave a Reply