Since our inception, there has rarely been a dull moment, and 2024 was no exception. While a global election year would naturally bring a degree of unpredictability, many of the year’s most significant surprises and sources of volatility stemmed from elsewhere, ranging from speculation around rate cuts and tech-driven market movements to Chinese stimulus measures— alongside the backdrop of the US election.

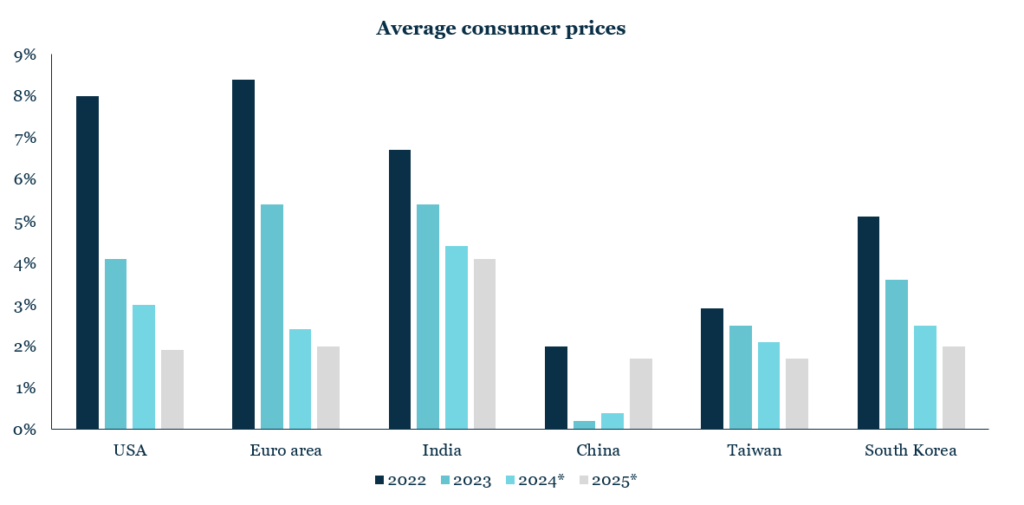

Amidst the turbulence, one of the more encouraging developments has been the ability of several developed and emerging markets to successfully steer towards what appears to be a soft landing, accompanied by the gradual (albeit occasionally uneven) normalisation of global inflation. While some fluctuations may still occur, the overall trend of easing inflation pressures, with only a few exceptions, seems clear.

For the MCP team, 2024 was a productive year, marked by extensive research trips to key markets resulting in several new additions to our portfolio. In-person meetings with companies, their competitors, local experts, politicians and economists inform our deep understanding of companies, and are an invaluable tool for conducting due diligence on investment ideas.

During these conversations and in follow-ups afterwards, we received positive updates from several companies in our portfolio that confirm our outlook. For example, Elite Material, a leading producer of semiconductor materials, is preparing to supply its upgraded M8 material for a US cloud service provider’s ASIC (Application-Specific Integrated Circuit) in 2025, addressing the growing demand for AI processing and the need for customised solutions over NVIDIA’s GPUs (Graphics Processing Unit). Similarly, Chroma has developed a unique device for its foundry client’s advanced packaging processes, ensuring precise alignment of stacked chip components, an essential capability for manufacturing next-generation AI chips.

Over the year, MEMF was able to generate robust outperformance returning 5.4% (Private C USD Founder) and 11.9% (Private C EUR Founder). In Q4, MEMF returned -2.3% (Private C USD Founder) and 5.0% (Private C EUR Founder), outperforming the benchmark (MSCI EM Mid Cap Index Net TR) by 6.5% (USD) and 7.0% (EUR) respectively.

The final quarter of 2024 has largely been defined by Donald Trump’s election victory, prompting businesses and governments worldwide to prepare for the implications of his second presidency. Additional key developments influencing emerging markets this quarter include the Fed’s second and third rate cuts of the year, the South Korean president’s controversial attempt to impose martial law, and the announcement of further stimulus measures in China aimed at bolstering economic growth.

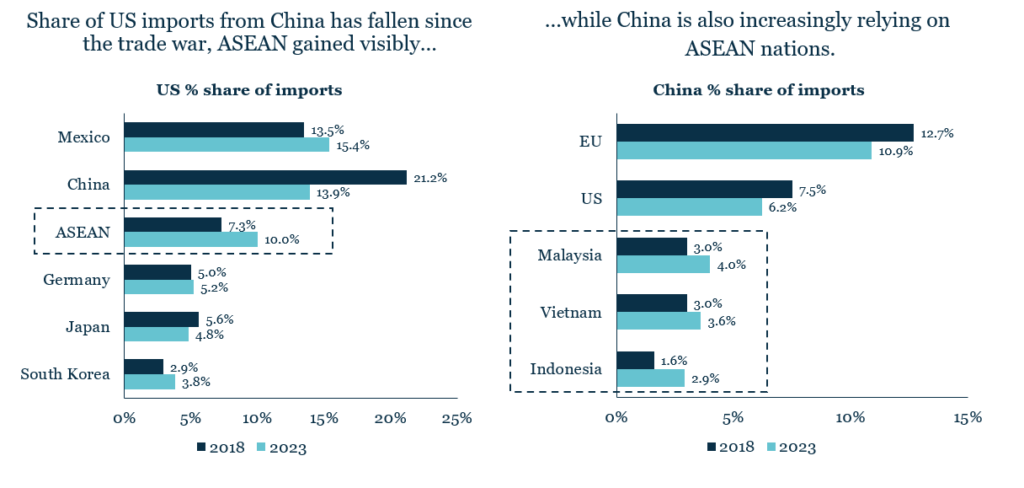

Donald Trump’s landslide victory and Republican control of Congress mark a pivotal shift for the US and global markets. While US equities and the dollar have strengthened in response, emerging markets face a more uncertain outlook due to Trump’s aggressive tariff rhetoric. Yet, as Einstein suggested, within difficulties lie opportunities. Countries like India, Indonesia and Vietnam, are already benefiting from the “China+1” strategy and appear well-positioned to attract new manufacturing investments. Their competitive labour markets, improving infrastructure and supportive government policies make them increasingly appealing, as companies seek to diversify supply chains and reduce dependency on China. At the same time, the US’s heavy reliance on imports, particularly from China, reduces the likelihood of sweeping tariffs, which could risk significant domestic disruption. Nevertheless, Trump’s track record and rhetoric on trade raises the possibility of bold policy shifts that may reshape global trade dynamics in the years to come.

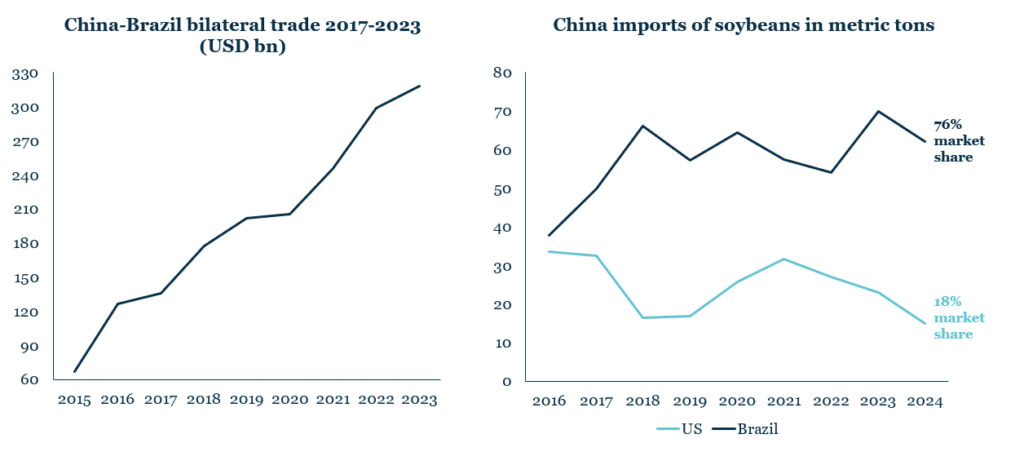

Emerging markets have previously responded to the above dynamics with increased trade diversification and reduced reliance on the US dollar. During the 2018 trade war, for example, China shifted imports like soybeans to Brazil, a move that fuelled record bilateral trade. This pattern could reemerge under Trump’s renewed tariff threats.

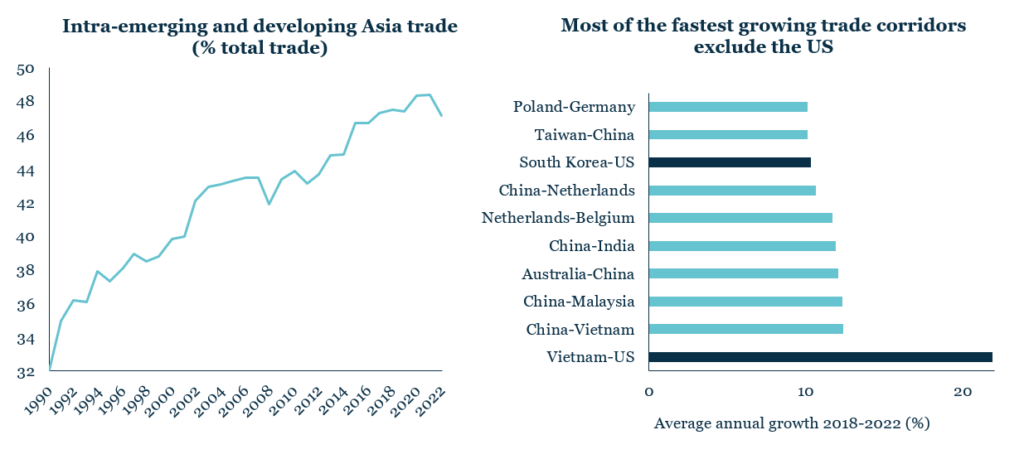

Rising Intra-EM Trade Reduces Dependence on US Trade

Additionally, nations such as India are advancing local currency trade agreements, fostering resilience against external shocks. Intra-EM trade, particularly within Asia, set to rise from $4.3 trillion in 2023 to $7.1 trillion in 2030 (HSBC Forecast), has also grown significantly and is poised to accelerate further, offering emerging markets the chance to deepen their autonomy and global influence.

Brazil-China Trade Grows as China Diversifies from the US

ASEAN Macro

Monetary policy adds another layer to this evolving landscape. Inflation has moderated over the past year, following the Federal Reserve’s earlier rate hikes. This had created room for monetary easing in 2024, with a cumulative 75bps rate cut signalling a shift in policy. However, the strength of the US economy may slow the pace of future reductions, even if the overall direction seems clear. Lower rates provide emerging market central banks with room to ease monetary policy, enabling cheaper borrowing, improved consumer sentiment and increased corporate investment. At the same time, local conditions remain pivotal. Brazil, for example, continues to raise interest rates to combat inflationary pressures. Nevertheless, we believe the country still holds attractive long-term opportunities, particularly in quality companies with strong fundamentals.

Global Inflation is Normalising

China, meanwhile, continues to grapple with significant economic challenges of its own, including its property sector crisis, weak consumer sentiment, and deflation. Recent stimulus measures, including a $1.4 trillion plan to address hidden debt and monetary easing, have provided only short-term relief. However, deeper structural reforms remain essential. The Politburo’s efforts to boost domestic demand and stabilise the property sector are positive signals, particularly in light of potential US tariff increases, but caution remains warranted.

Geopolitics remains an ongoing risk, with tensions in the Middle East, the Russia-Ukraine war, and China-Taiwan relations posing significant challenges. Our disciplined macro-overlay has been instrumental in navigating these complexities. This approach will remain central as we navigate 2025. On the positive side, Trump’s leadership may offer the potential to de-escalate conflicts and foster peace negotiations—a trend that may already be emerging in the Middle East at the time of writing.

Taken together, these interconnected factors paint a complex picture for 2025. While risks are evident, emerging markets could leverage this period of transition to strengthen resilience, diversify trade and attract investment, positioning themselves as key drivers of global growth in the years ahead. Furthermore, emerging markets are essential for diversification, offering strong growth potential, attractive valuations and innovative companies that play a key role in global supply chains. This is particularly important as the US market, with the S&P 500 heavily concentrated in just seven companies which were accounting for around 28% of its market capitalisation at the end of 2024 and contributed over 50% of its returns during the year, poses significant concentration risks. Active investing in emerging markets allows for another layer of diversification by identifying lesser-covered companies, which may offer unique opportunities for long-term growth and the potential to outperform broader market trends.

Heading into 2025, we remain focused on our long-term strategy and the core fundamentals of our holdings. Conversations with our portfolio companies in recent months have reinforced our cautiously optimistic outlook for 2025 and beyond.

Leave a Reply