For the MCP team, 2024 has been a productive year, highlighted by extensive research trips to key markets which we believe provide us with a competitive edge. In-person meetings with portfolio and pipeline companies, local experts, policy makers and private equity houses have provided invaluable insights into macroeconomic and geopolitical trends, businesses’ operating conditions and corporate governance, as well as enabling in-person engagement. Additionally, in under-researched emerging markets, where stocks can be mispriced due to limited available information, these trips are essential for uncovering high-quality investment opportunities that have the potential to deliver significant alpha.

The Importance of a Strong Network

We believe the key to successful research trips lies in having a trusted and extensive network. Our 25-year network is built on Portfolio Manager Carlos Hardenberg’s decades of experience in emerging markets and complemented by the industry relationships built by MCP’s analysts throughout their careers.

We don’t expect our analysts to be experts in everything, but we do expect them to know where to access relevant information, including identifying key contacts during research trips. Building these robust networks—and leveraging the valuable insights they offer—drives our commitment to frequent research trips, which in turn, creates further opportunities to engage with local experts and businesses, continually expanding our network. We adopt a targeted approach to our research trips, customising each trip to align with the unique macroeconomic and geopolitical conditions of the region and the specific characteristics of the opportunity set. This allows us to gain a deeper understanding of both country- and sector-specific challenges. Furthermore, our priority is to visit regions where we hold a strong investment conviction and have a higher portfolio exposure, leading to the majority of our trips being concentrated in Asia.

For example, during a research trip to Greater China in Q2 2024, in Taiwan, our highest country exposure, the team prioritised meeting with portfolio companies’ management teams and actively driving engagement. When the team continued to mainland China, they focused on conducting visits to manufacturing facilities of portfolio companies with operations in the region. In contrast, when the team visited Vietnam in Q3—where our exposure is just 3%— they prioritised exploring new opportunities through meetings with pipeline companies and local experts, which ultimately led to the addition of a new holding, FPT.

Looking Beyond the Sell-Side

In today’s investment landscape, it is all too easy to believe you have all the information you need at the click of a finger. When investing in well-known highly liquid stocks, information is readily available through sell-side reports, online resources and advanced data platforms such as Bloomberg. However, the ubiquity of this information leaves little room for competitive knowledge advantage in what are highly efficient markets. Moreover, relying solely on sell-side information often overlooks the depth, nuance and context that can only be gained through on-the-ground research.

In contrast, our focus is on identifying and understanding lesser-known companies. By concentrating on mid-cap stocks in emerging markets, we operate in a universe that is often under-researched, with limited sell-side coverage, reduced visibility and minimal overlap with major benchmarks. This lack of broad market coverage often leads to mispricing, creating opportunities to generate alpha by identifying undervalued companies with strong fundamentals. However, investing in these types of unknown stocks also demands rigorous, independent, in-person channel checks. While conducting this research, our team maps the competitive landscape, evaluates total addressable market (TAM) opportunities and stays informed about sector innovation and R&D trends.

Therefore, for our investment strategy, conducting research trips is not just beneficial—it is essential. These trips allow us to look for hidden opportunities, gain insights that others might overlook, and capitalise on market inefficiencies with the aim to generate additional sources of alpha.

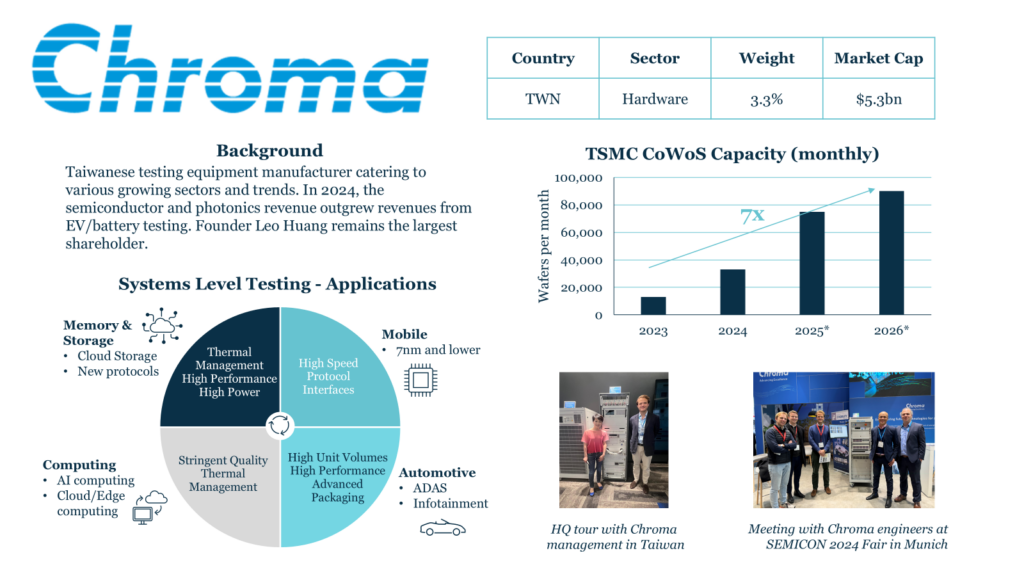

Company Case Study: Chroma

The Greater China trip in Q2 2024 exemplifies how a well-structured research trip can profoundly enhance our understanding of a portfolio company. During this trip, the team focused on Chroma, a Taiwanese equipment supplier and a recent addition to the portfolio. Spending several weeks immersed in Taiwan’s vibrant semiconductor ecosystem, the team conducted comprehensive channel checks on Chroma.

Traditionally a manufacturer of testing equipment for EV and battery applications, Chroma has leveraged its expertise in thermal management to establish a foothold in the niche market of systems-level testing for high performance computing chips (HPC).

Through formal meetings, campus tours and discussions with technical experts, MCP gained deeper insights into the demand dynamics for Chroma’s innovative products. A standout example of its innovation-driven approach is the development of a cutting-edge metrology tool designed for a leading foundry’s advanced packaging process. This breakthrough positions Chroma to capitalise on the foundry’s rapid capacity expansion, driven by the growing demand for CoWoS (Chip-on-Wafer-on-Substrate) technology as the AI/HPC boom accelerates.

Enhancing Geopolitical & Macroeconomic Insights

Over the past year, the MCP team has visited India on several occasions, Greater China— including Taiwan, Hong Kong, and mainland China—as well significant portions of ASEAN, including Vietnam, Malaysia, Thailand and Singapore. As well as providing company-specific insights, in-person visits help us to assess the broader environment and challenges that companies operate in by providing a deeply informative perspective on each country’s macroeconomic landscape and enabling us to closely monitor risks, including regulatory changes and geopolitical tensions. Based on observations from recent on-the-ground trips to Greater China, we believe that the likelihood of a Chinese invasion of Taiwan in the short term appears low, given the substantial domestic economic challenges China is currently facing. However, we continue to monitor the situation very closely.

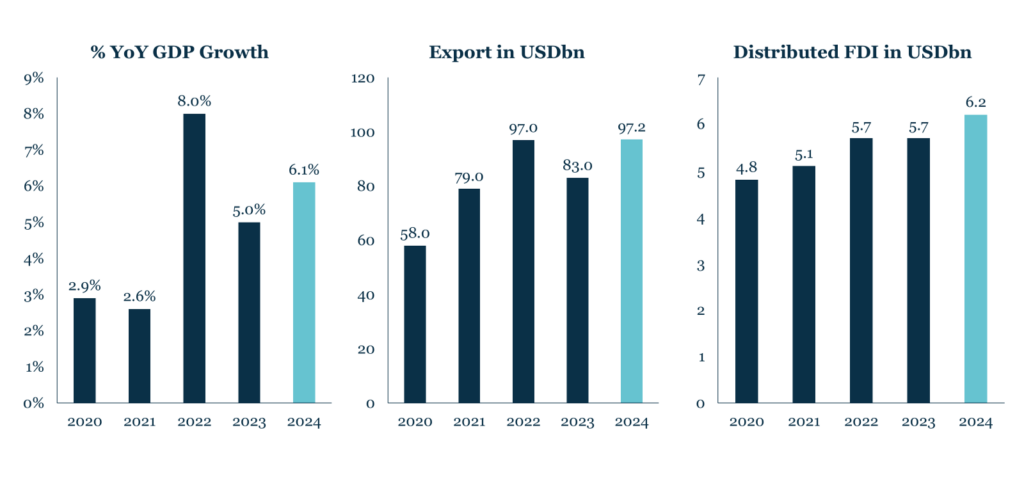

As we move into 2025, we do so with a strengthened bullish conviction in ASEAN, particularly in Vietnam, following the team’s visit to the country in September. Leveraging Carlos’ extensive network, the trip provided access to company founders, entrepreneurs, local private equity leaders, government officials, former colleagues and numerous businesses. The team also visited a local tech university and even test-drove the new VinFast car through the streets of Hanoi.

These meetings and conversations, combined with Carlos’ two decades of experience traveling to Vietnam, highlighted the country’s remarkable pace of technological innovation and transformation—an insight that stood out as the trip’s primary takeaway. Everyday observations further reinforced this perspective, from the widespread use of Grab (Asia’s version of Uber) as the primary mode of transportation, to seamless digital payments via Apple Pay.

Other key takeaways highlighted Vietnam’s impressive, world-class infrastructure—spanning airports, roads, and bridges — a business-friendly government, and significant strides in corporate governance. Collectively, these factors reinforced our optimistic view of the country’s strong growth trajectory, which we believe will support its transition to emerging market status.

Opportunities in ASEAN: Example Vietnam

2024, FT, Export and FDI figures as of Q2 of each year

While we are excited about opportunities in Vietnam, our core convictions remain in India, Taiwan and South Korea. Research trips to these regions have reinforced our convictions, highlighting the innovation of local companies, strong corporate governance practices and supportive macroeconomic environments. India’s well-educated, youthful population supports long-term growth, while Taiwan and South Korea lead in innovation, particularly in tech sectors such as AI, 5G and renewable energy, where we favour asset-light, IP-based businesses.

Although South Korean President Yoon Suk Yeol shocked the nation and global investors with his failed attempt to impose martial law in December, we believe the Constitutional Court’s decision to impeach Yoon, leading to his arrest in January 2025, highlights the strength of the country’s democratic framework which will allow the country to focus on its economic potential. Fundamentally, we remain confident in the country’s stability and its promising investment opportunities, particularly in the export market.

Conclusion

In 2025, the team is excited to continue these on-the-ground research trips to both familiar and unfamiliar markets. Trips already planned include India, Taiwan and Latin America, with additional trips to follow later in the year. These visits will allow MCP to conduct in-depth channel checks on portfolio companies, perform rigorous due diligence on pipelines companies, stay attuned to evolving macroeconomic and geopolitical trends, and conduct in-person engagement.