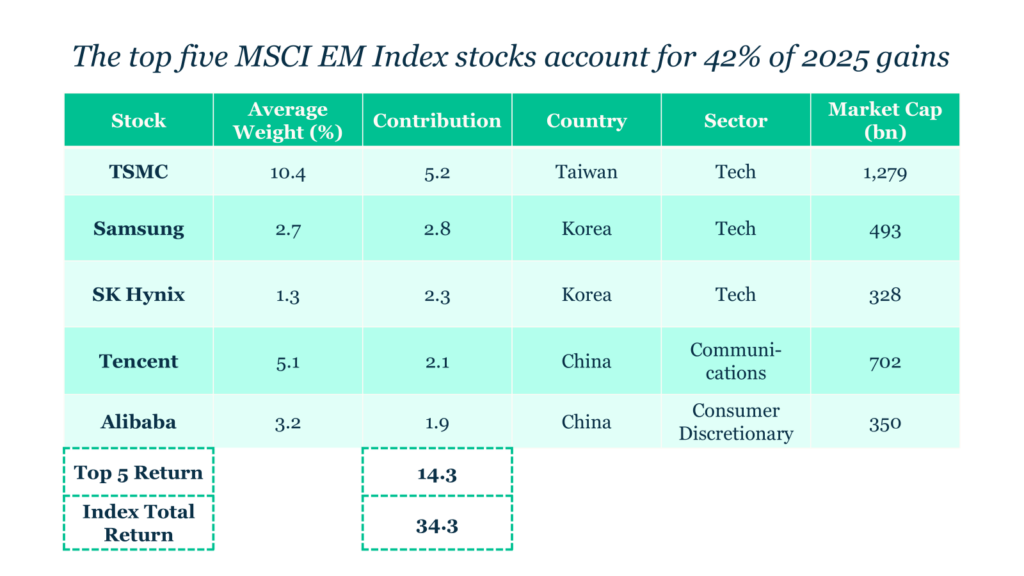

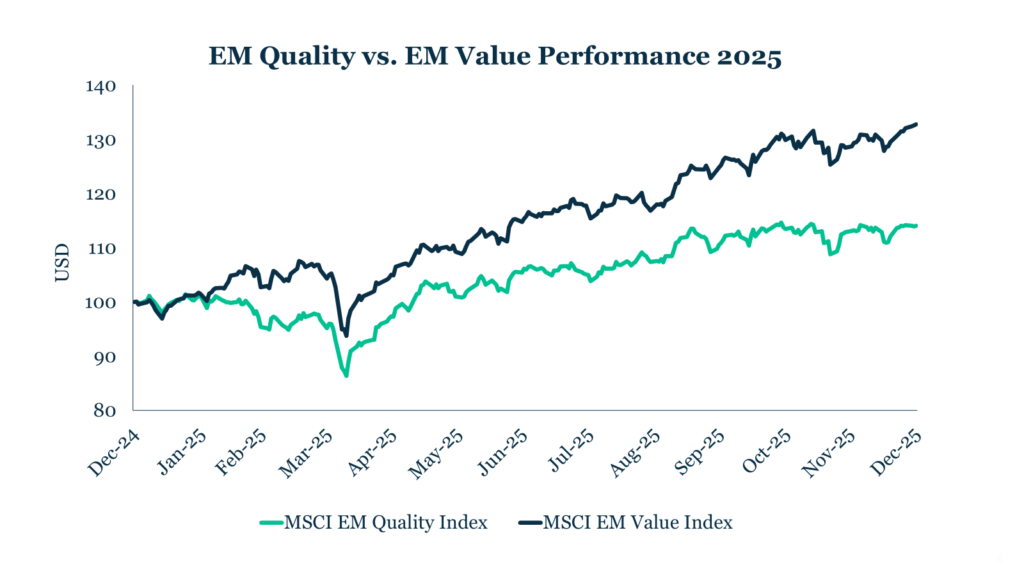

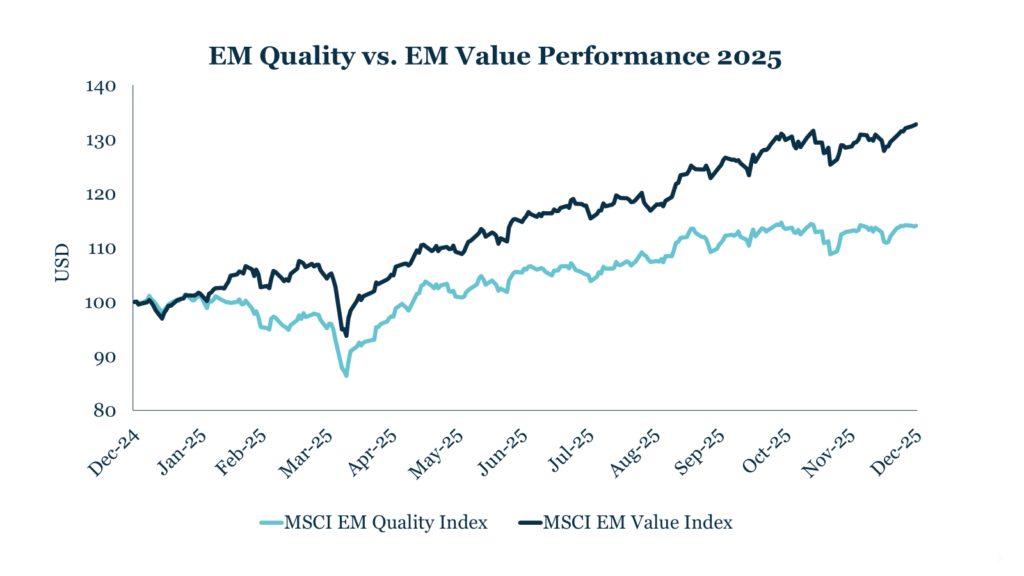

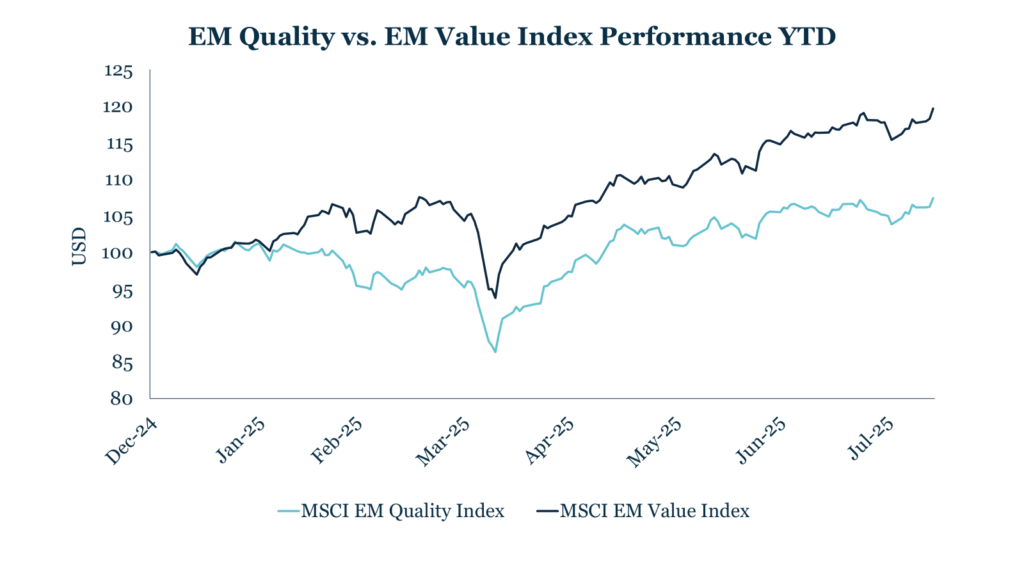

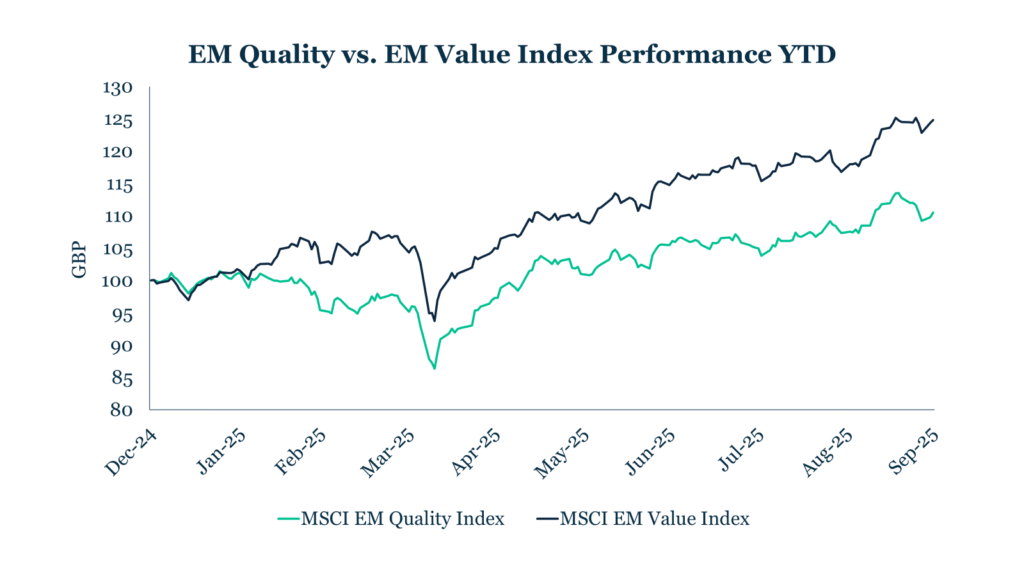

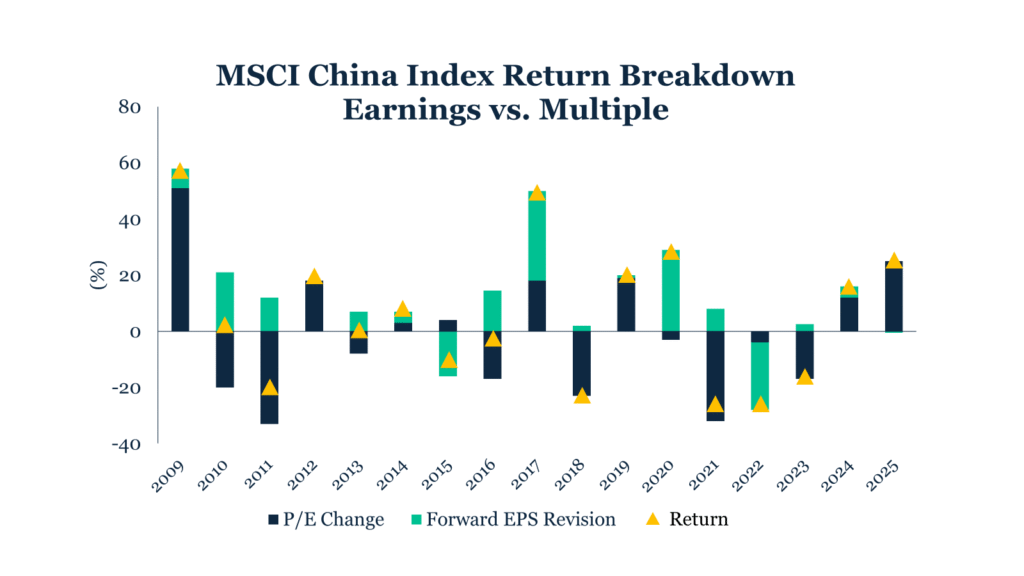

In contrast to previous years, when MEMF delivered strong returns driven by small- and mid-cap emerging market companies despite broader EM equities lagging, the asset class entered a recovery phase in 2025. Emerging markets demonstrated to global investors that they can deliver strong returns in a market previously dominated by American exceptionalism.

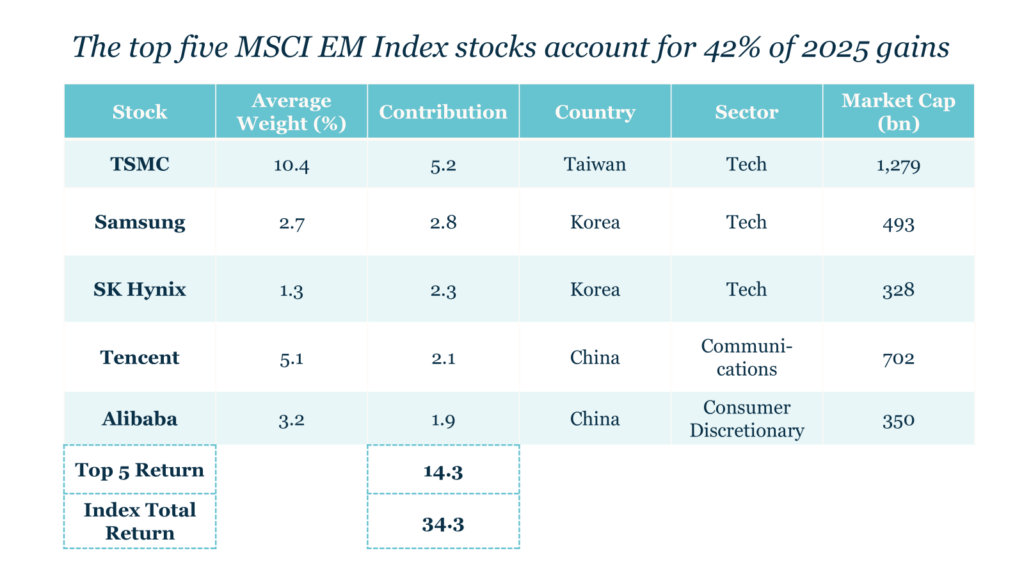

However, the benefits were largely captured by a small number of mega-cap stocks, resulting in unusually narrow market leadership. While gains have been highly concentrated so far, a broader set of supportive dynamics for emerging markets should increasingly extend beyond the largest stocks and benefit quality small- and mid-cap companies.

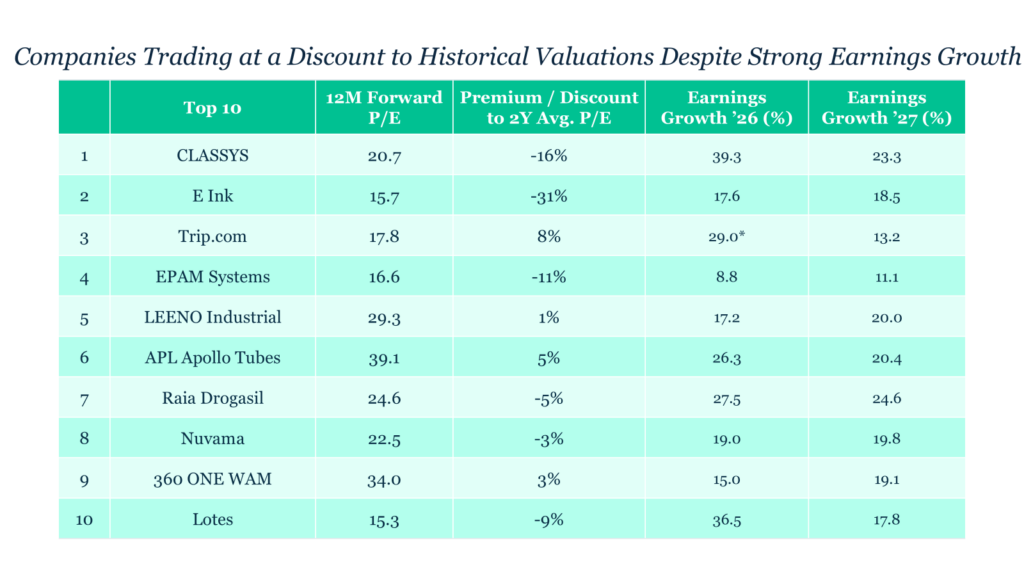

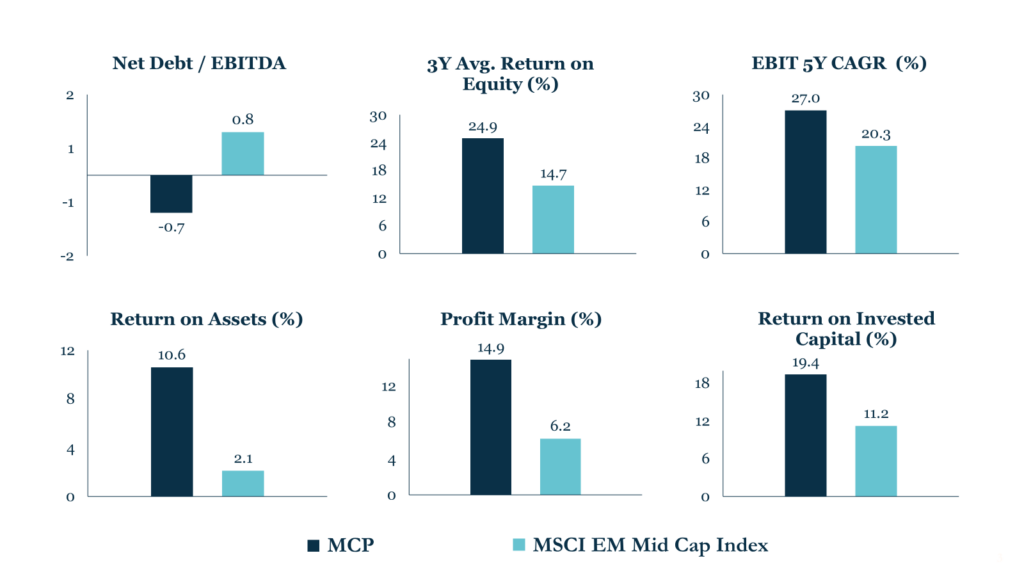

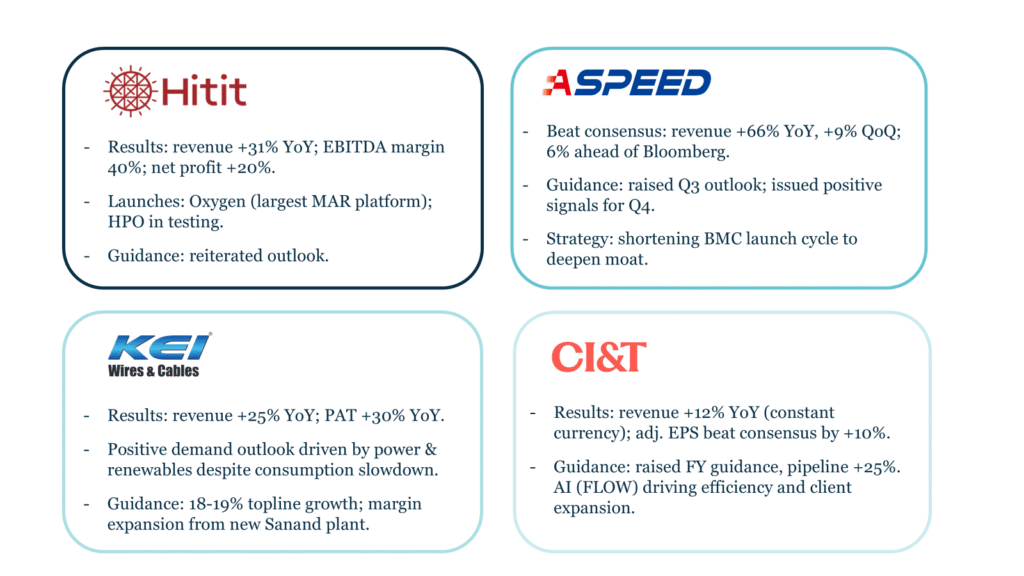

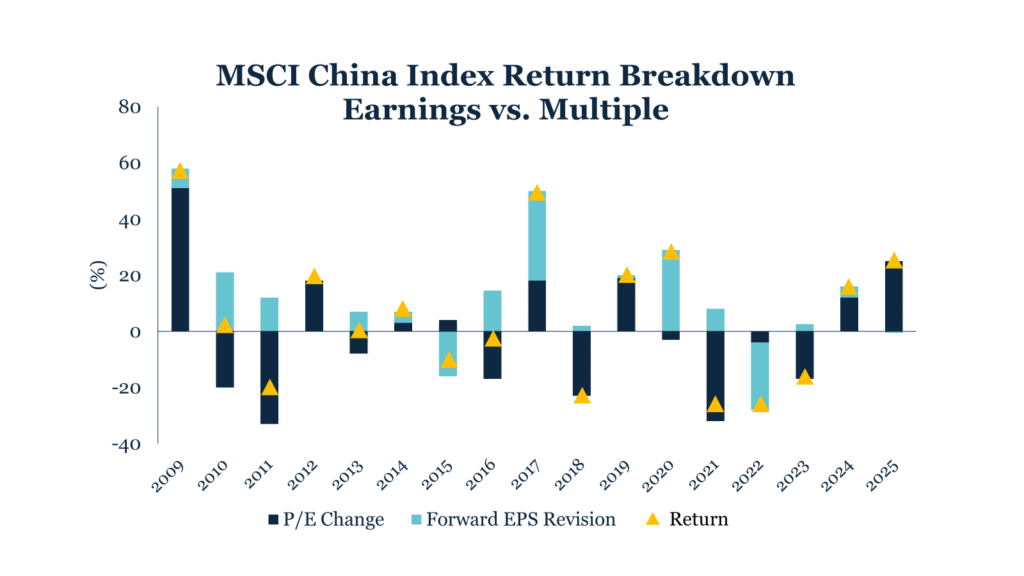

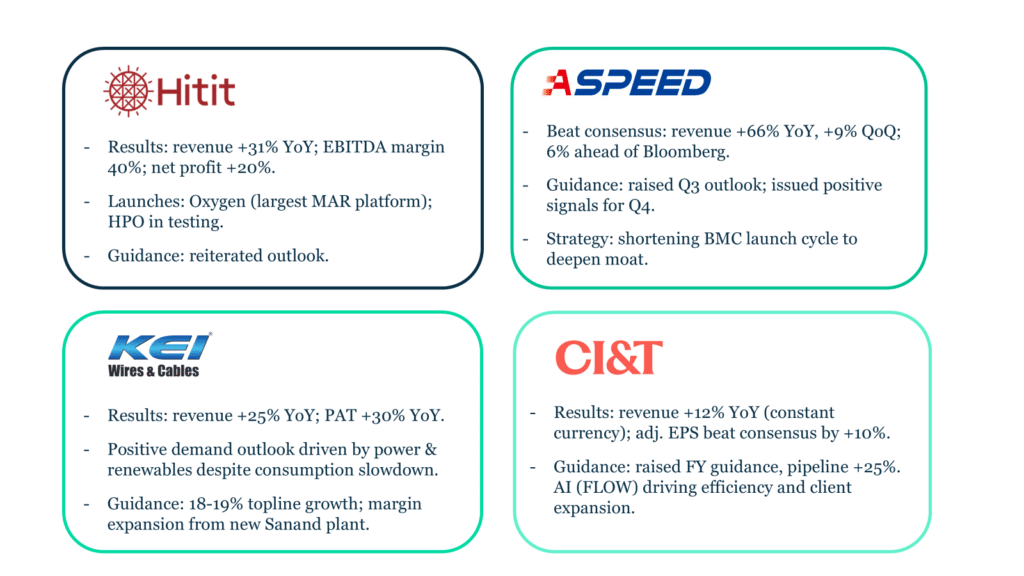

At the same time, many of our holdings have continued to execute well operationally, but this has not been fully reflected in share prices due to macroeconomic headwinds. As these pressures ease, we see scope for a catch-up in valuations, providing support to the portfolio in the years ahead.

Emerging Markets Supported by Numerous Tailwinds

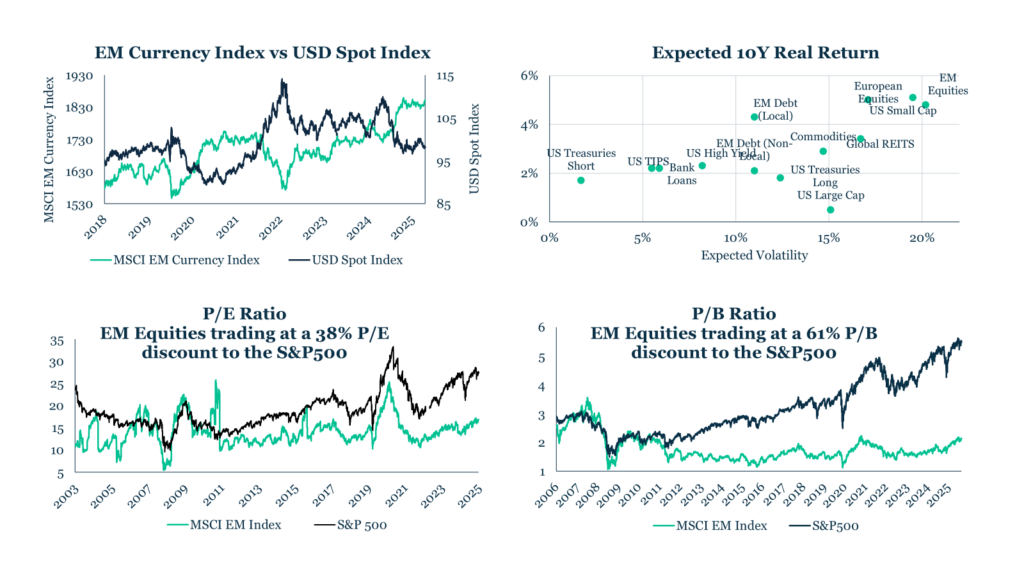

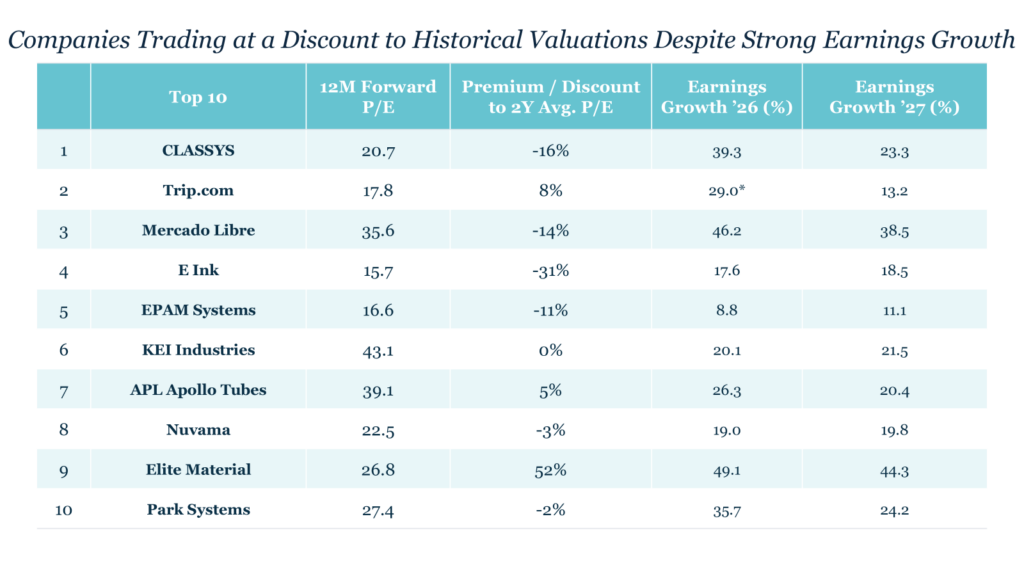

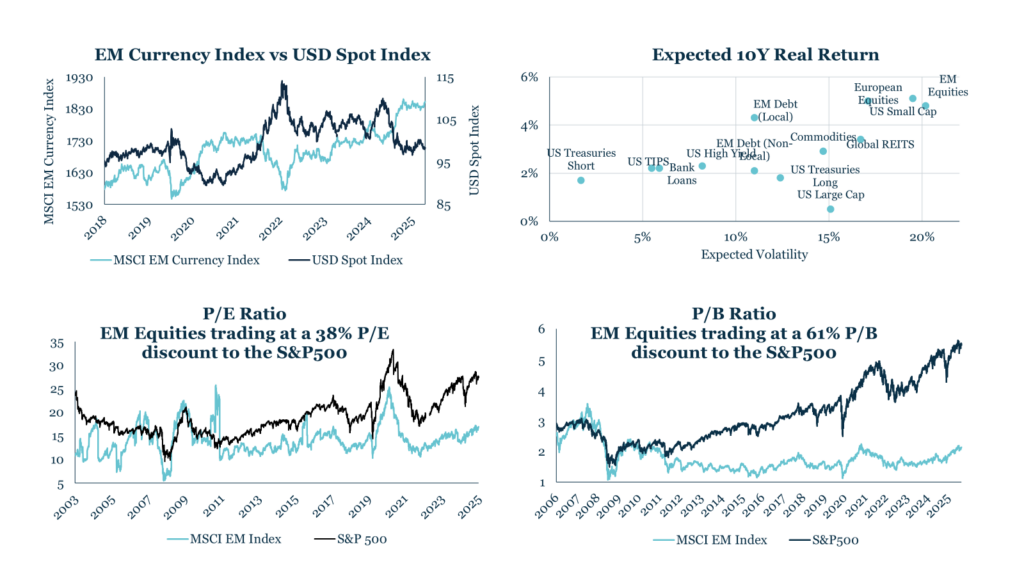

At year end, emerging markets were trading at a 38% discount on a P/E basis and a 61% discount on a P/B basis relative to developed markets. These valuation gaps are particularly pronounced in the sectors we focus on, such as technology and consumer discretionary. Importantly, the attractive discounts noted above are also increasingly evident across quality stocks, extending beyond traditional value segments.

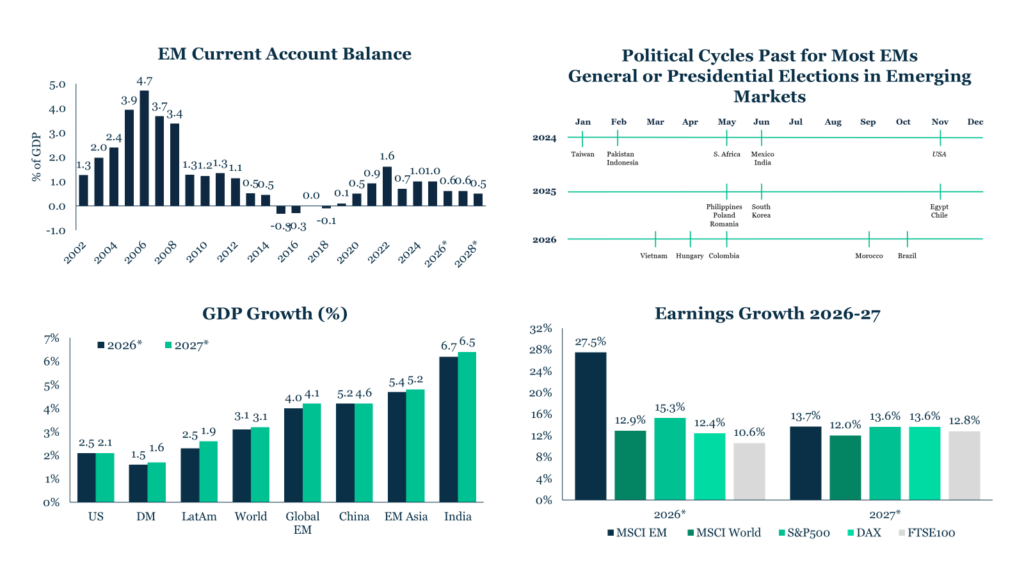

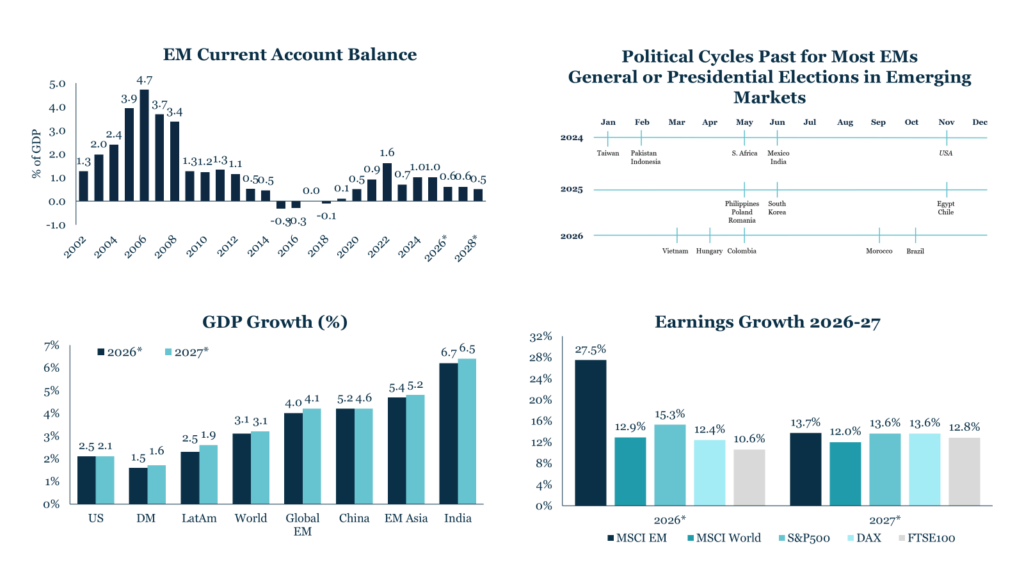

Furthermore, emerging markets are supported by a 9.4% weakening of the US dollar in 2025, which is expected to continue into 2026. This typically benefits EM currencies, with the Brazilian real, Colombian peso and Taiwanese dollar among the strongest performers this year. EM bond spreads are also near some of their highest levels. Emerging markets continue to maintain healthier debt levels than developed markets (69% versus 109% of GDP in 2024), while simultaneously offering stronger GDP and earnings growth projections.

Higher Growth in EMs Combined with Healthier Debt Levels

Political risk related to elections is currently cyclically low, with major electoral events in 2026 limited to Vietnam and Brazil across our key markets. However, geopolitical risks more broadly remain elevated. Recent developments, including tensions between the US and Europe over Greenland and events in Venezuela, have already added complications to the outlook for 2026, alongside long-standing risks such as the Russia–Ukraine conflict, instability in the Middle East, global trade wars, and ongoing tension between China and Taiwan. We remain highly mindful of geopolitical risks and always apply a macro risk overlay to our bottom-up stock selection.

The Federal Reserve’s expected rate cuts this year further enhance the outlook, as lower US yields generally push investors toward higher-return emerging market assets—particularly as many EMs benefit from moderating inflation and higher real rates themselves. While effects may vary across countries, the global easing cycle provides a broadly supportive backdrop for EM performance.

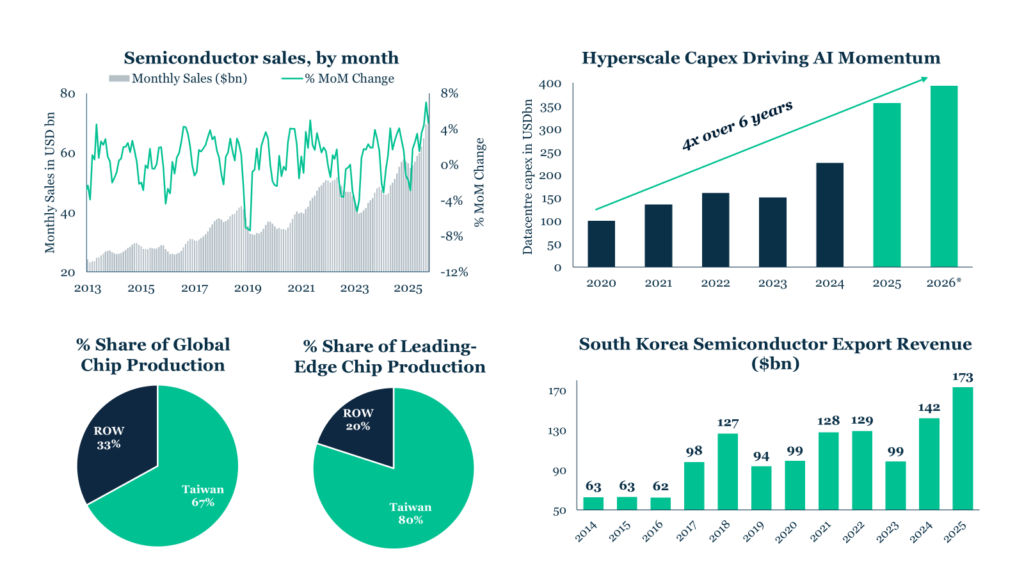

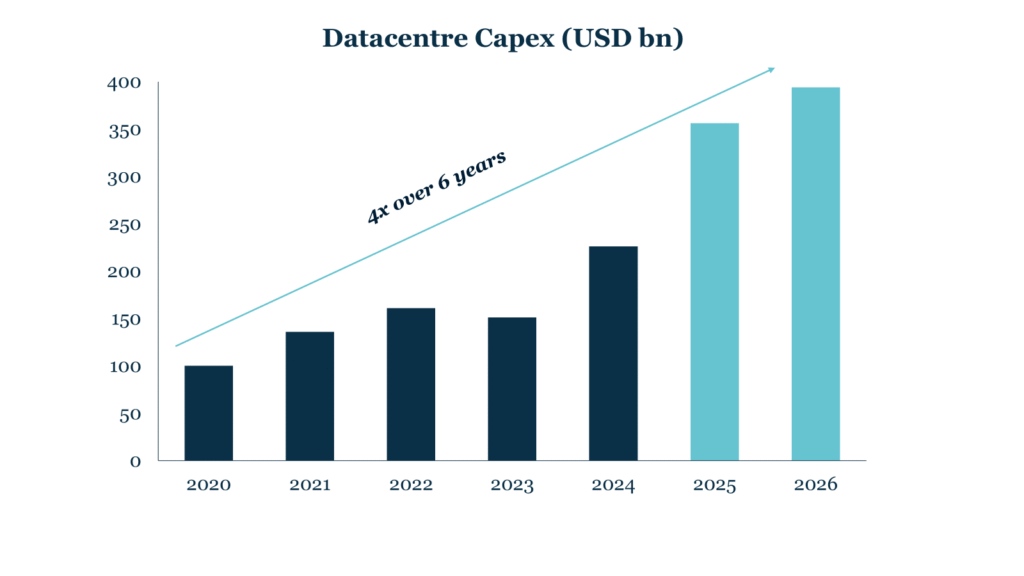

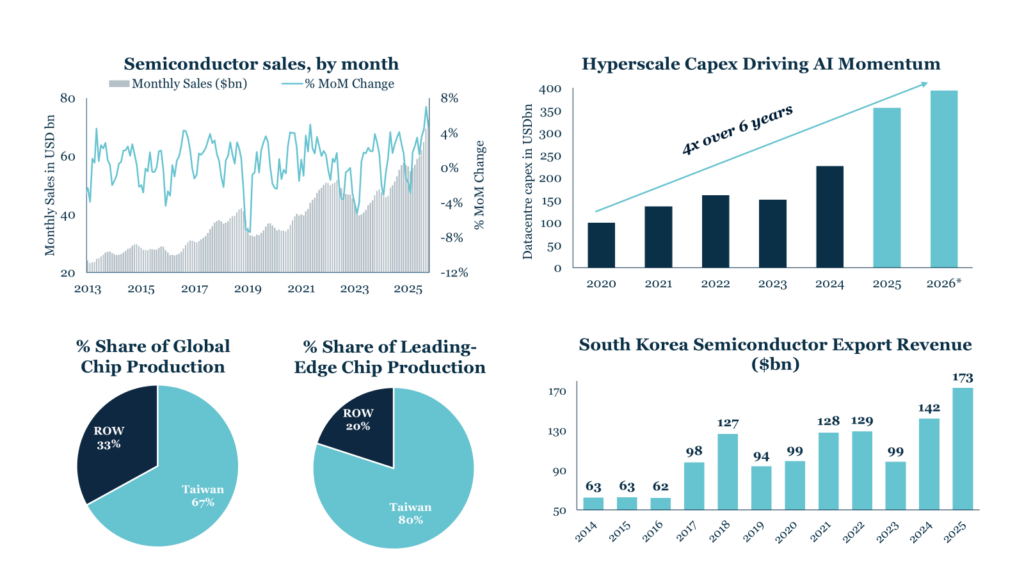

Furthermore, a number of country-specific tailwinds should support our portfolio exposures. Taiwan continues to benefit from a powerful semiconductor investment cycle and a globally competitive innovation ecosystem. South Korea is advancing structurally in high-end manufacturing, materials and automation, where we continue to find globally competitive businesses trading at attractive valuations.

Taiwan and Korea Well Positioned in Semiconductor and AI Markets

Times, South Korea Ministry of Trade. * indicates forecast. Data as of 31 December 2025.

Despite a challenging start to 2026, marked by foreign outflows amid reduced risk appetite and heightened macro volatility following recent geopolitical developments, India’s longer-term outlook remains compelling. We continue to look through near-term volatility, supported by resilient GDP growth, rising discretionary consumption and improving capital expenditure trends. The year 2026 could turn into another period of significant progress for the country.

Brazil offers selective opportunities as inflation moderates, interest rates decline and corporate balance sheets strengthen. We remain cautious around the upcoming elections, which are likely to introduce additional volatility in 2026.

While emerging markets have delivered strong headline returns this year, dispersion beneath the surface has been significant. With valuation spreads at elevated levels and earnings revisions diverging meaningfully by country, sector and company, passive exposure increasingly reflects index concentration rather than the breadth of opportunity available.

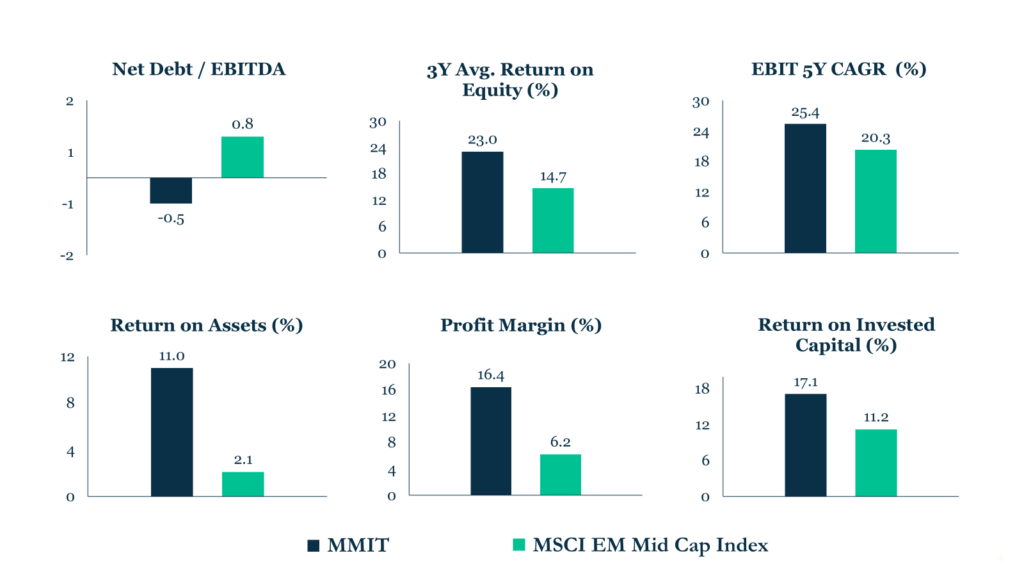

In this environment, disciplined bottom-up stock selection is essential to identifying structurally stronger businesses beyond benchmark heavyweights. We believe the portfolio is well positioned should the recovery broaden into under-owned areas of the market where fundamentals remain intact.

With a portfolio built around high-quality, lesser-known companies and a disciplined, active approach to capital allocation, we remain fully committed to our investment philosophy and to delivering long-term performance and shareholder value.